Managing debt can be a traumatising experience. The global economic shock resulting from the COVID-19 pandemic has made dealing with debt even more challenging for many borrowers – consumers and businesses alike. People have lost their jobs or have to live on reduced income while companies are struggling with a drop in sales and spikes in operating expenses.

The economic fallout means that dealing with debt for some borrowers now competes with basic needs such as putting food on the table and paying rent. For many businesses, they have to decide between meeting a debt obligation and keeping their operations running. Indeed, the tough times force some companies to take on more debt just to try to shore up struggling subsidiaries while forgoing capital investments.

Economic hardship means some borrowers will be forced to prioritise their debt repayment, where they have multiple outstanding borrowings.

Now is the time debtor needs support from its creditors to survive this unprecedented global health and economic turmoil. It is a time when ethics and empathy should guide the debt collection process more than ever.

Creditors and collectors should not just focus on achieving the possible debt recovery but also the ethical treatment of debtors. You don’t want borrowers already in financial hardship to feel harassed, which could only complicate debt collection. There is a need to recover debts, but you will need today’s struggling borrower tomorrow to drive your business. Lenders will appreciate that applying ethical debt collection methods can work in their favour in the long-term. This crisis may present a golden opportunity for lenders to build higher customer loyalty if they can re-imagine their debt collection methods.

Importance Of Ethical Debt Collection Practices

The credit sector has been at the forefront of driving robust economic growth across the Asia region. There is no doubt that the credit sector will also play a central role in supporting post-COVID-19 economic recovery in Asian economies such as India, Vietnam, and Indonesia.

Loss of jobs or a drop in earnings has reduced borrowers’ ability to service loans and heightened the risk of defaults or non-performing loans for banks. Indeed, the Covid-19 impact has made it clear that a struggling borrower is a lender’s problem.

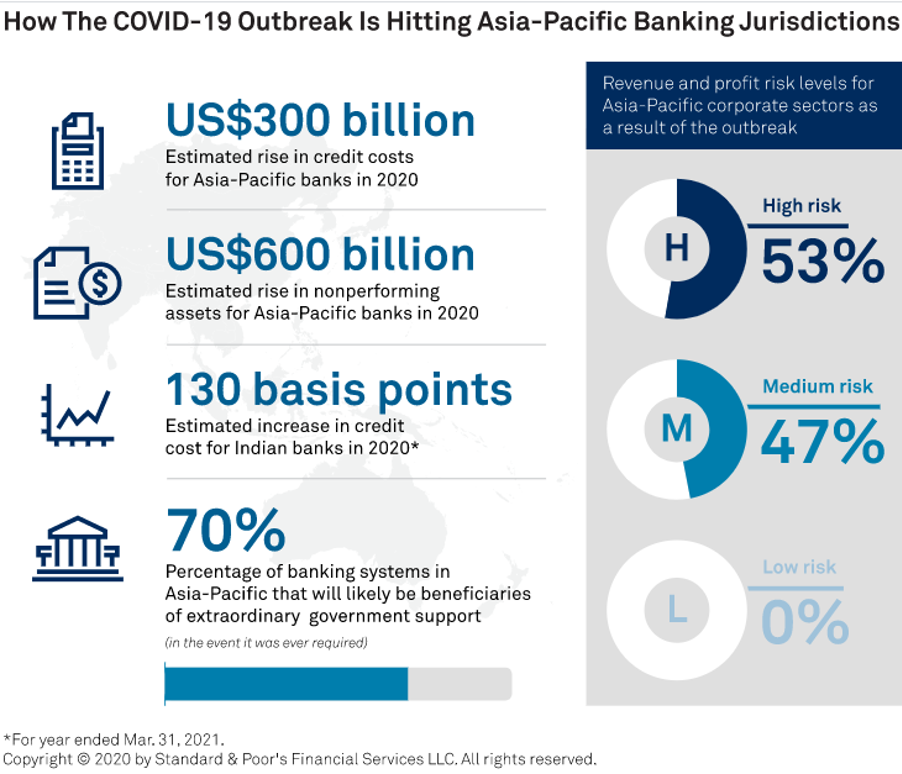

According to S&P Global, from adverse events happening this year, it will see that Asia-Pacific banking’s non-performing assets will jump by $600 billion in 2020. Consequently, banks in the region will see credit losses increase by $300 billion in 2020.

Lenders need to be patient and extend the right solutions to borrowers in hardship. By adopting ethical collection strategies, banks can take advantage of this economic crisis to burnish their reputation as financial institutions that borrowers can trust to stand with them in times of distress. That could go a long way into increased customer loyalty.

Applying ethical collection strategies can help banks to understand their customers better and apply the lessons to make appropriate operational and system adjustments for competitiveness. For example, a bank may get to identify borrowers requiring additional loans to get back on their feet quickly and continue their normal repayment plan. Moreover, a bank may get to identify customers who require adjustment in repayment plans to avoid fall into insolvency.

How Ethical Debt Collection can be Done?

Southeast Asia’s economies have been recording robust growth in recent years. But the robust growth could grind to a near halt this year because of COVID-19 headwind. Indonesia, for instance, registered a GDP growth of 5.2% in 2018 and 5.0% in 2019. But IMF estimates show that Indonesia’s GDP growth could plunge to just 0.5% in 2020. In Vietnam, GDP growth is forecast to slow down to just 2.7% in 2020 from 7.0% in 2019 and 7.1% in 2018. Consequently, Asian Development Bank sees Southeast Asia’s GDP growth plunging to 1.0% in 2020 from 4.4% in 2019 and 5.1% in 2018.

The debt collection industry in Asia remains deeply manual and inefficient, or even hostile to debtors. For example, the use of field agents in debt collection is more inappropriate now because of social-distancing requirements. Moreover, field collection practices can be prone to hostile actions that can lead to legal and regulatory problems. Besides being inefficient and prone to actions that can generate customer conflicts and bring about legal and regulatory headaches, traditional debt collection practices also require massive investment in time and labour. Therefore, Asia’s debt collection industry needs to evolve to be able to provide solutions that address today’s market needs.

First, lenders must recognise that debt collection can be emotionally challenging for both agents and debtors in times of economic distress. Therefore, investment in the emotional intelligence of debt collection staff can help reduce incidents of conflict that can complicate debt recovery. With emotional intelligence staff, creditors can match borrowers with debt collection staff that is best-suited to handle their case for the desired outcome. That would, in turn, increase debt recovery chances.

Technology also help lenders improve loan recoveries while still preserving customer loyalty and remaining compliant with regulatory requirements. Here are some ways creditors can apply technology solutions to support borrowers in financial hardship during these distressing times.

Agility through Automating Debt Collection Process with Self-Service Options

Lenders can make their debt collection work more efficient through automation. The digital debt collection process will reduce labour requirement while still allowing for handling larger volumes than manual methods.

Automated collection can also improve the trust between borrowers and creditors, which is vital for sustaining customer loyalty. Providing debtors with self-serve options can simplify and speed up a collection, reducing the burden on both the lender and borrowers.

Technology has dramatically transformed how people engage with their financial service providers. Debt collectors can take advantage of the technology to reap the benefits of efficiency that come with it. For example, online self-service tools have enabled people to obtain answers to their financial questions and obtain support without interacting with another human. Therefore, creditors and debt collectors, too, should extend self-service options to customers as this method also carries cost benefits. For example, an online payment portal will allow debtors to make payments toward reducing their loan repayment. That will enable creditors to continue receiving loan repayments even outside business hours, and that can speed up debt recovery and cut costs associated with it.

Self-service tools that allow debtors to repayment schedules on their own can also remove some pressure on borrowers. For example, a lender can provide online tools that borrowers can use to increase the loan instalment amount they feel comfortable paying depending on their ability. Additionally, online devices that allow borrowers to adjust the repayment duration can also be relieved and help make collection less stressful.

Flexible repayment options will encourage borrowers to continue working to reduce their debt. Moreover, extending flexible repayment options allows borrowers to adjust for unforeseen events that affect their commitments, and that can boost customer trust besides minimising loan losses.

Borrower Segmentation And High-Impact Messaging

These are times when consumers have come to expect a personalised experience from their service providers. That includes from creditors and debt collectors. Therefore, collectors need to adopt communication methods to improve the timing and tone of messaging for better outcomes.

Adopting the right communication channels has become even essential for debt collection during these distressing times. For example, reaching out to distressed debtors with a custom message that speaks to their hearts can reduce tensions and open up opportunities for an arrangement that leaves the customer feel appreciated and cared for.

Lenders should apply artificial intelligence and machine learning technologies to help them better predict loan default risks. Artificial intelligence technology can help lenders quickly segment borrowers to use the most appropriate solution to maximise recoveries. That should help make debt collection both more efficient and humane during this crisis period.

Moreover, borrower segmentation and targeted message can help creditors better understand the underlying cause for default. AI and ML analytics will help lenders to group borrowers into categories based on their repayment probability.

Therefore, lenders can apply technology to distinguish borrowers who require human contact from those who can be served through automated channels. Borrowers showing higher repayment probability will require effort, allowing recovery resources to be allocated more prudently. Therefore, this type of borrowers segmentation allows collection staff to apply their time more effectively and reduces the cost of recovery.

Moreover, creditors can apply segmentation to deliver custom messages that show empathy, which helps build customer trust and loyalty. Of course, these are times when lenders would not want to jeopardise customer loyalty as it is important in driving business growth in these uncertain economic conditions.

Lenders can also take advantage of technology to provide self-service customer education, such as through FAQs. That can go a long way into helping borrowers make a better financial decision, which can, in turn, reduce incidents of defaults.

The Need to Adjust Quickly- Agility in Debt Collection

The COVID-19 pandemic has created extraordinary times for creditors and debtors. Communication is important in these times to get to understand the circumstance of the debtor. Equally important is personalised communication. It can help establish a trust foundation that increases the chances of recovering outstanding loans. There is no doubt that lenders who adjust quickly to these uncertain times can improve debt recovery while ensuring sustainable operation.

Key differentiator is lenders who react faster on this economic distress not just to maximise their recoveries, but also build a more robust relationship with their customers. Ethical debt collection practice is critical now more than ever.

International (EN)

International (EN) Indonesia (ID)

Indonesia (ID) India (EN)

India (EN)