Technology is transforming almost everything around us, and the debt collection industry is no exception. With its mostly manual, labor-intensive process, the debt collection industry in Asia is overdue for tech disruption.

If anything that debt collection agencies can learn from the Covid-19 pandemic, the legacy approach to a collection is no longer tenable. For example, the requirement to maintain social distancing to curb the spread of coronavirus rendered agencies that rely on traditional collection methods ineffective in helping their clients recover overdue loans.

Machine learning (ML) technology as a solution of smart debt collection fixes the many challenges agencies, creditors, and borrowers face in trying to recover overdue debts. For collection agencies, this can significantly improve operational efficiency and compliance.

The way Artificial Intelligence (AI) works isn’t a mystery. Learn from your historical data and predict future possibilities more efficiently and effectively. If applied properly, AI can give a 360-degree view of the borrowers, which can, in turn, help lenders to prioritise debt collection better to maximise recovery yields.

However, as promising as it is, data-driven debt recovery is still plagued by many challenges, especially with the rise of data security and privacy concerns. The challenges have limited updates and sometimes hampers the effectiveness of data-driven solutions in the debt collection industry. Therefore, unlocking the full potential data-driven collection relies on identifying the challenges and overcoming them.

Challenges in implementing AI in debt collection

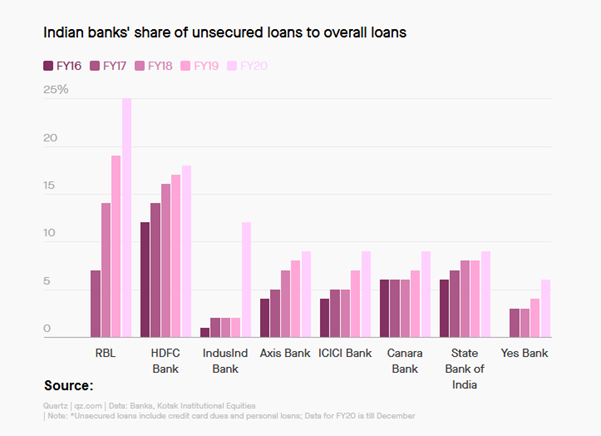

There’s no doubt that the data-driven approach holds the promise to a bright future for the debt collection industry. With the Covid-19 pandemic expected to increase credit defaults across Asia and the world, the debt collection industry needs the right tools to support their clients in recovering overdue loans. In India, for instance, the rapid rise in retail lending has left banks staring at a sharp spike in credit defaults in the unsecured loan sector.

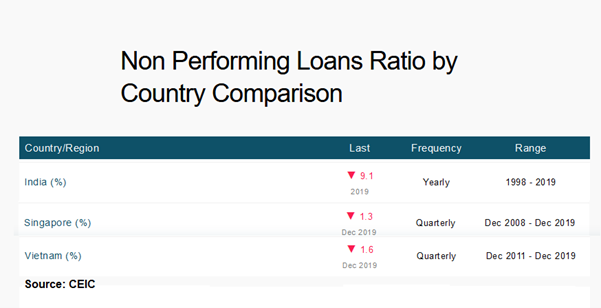

There is much work generally for the debt collection industry. For example, the level of non-performing loans remains high around the world. The chart below shows the non-performing assets ratio in Singapore, Vietnam, and India.

Unfortunately, most lenders trying to leverage AI to improve debt collection still encounter many problems. Without knowing what to do about these problems or where to turn for solutions, they have yet to see the full benefits of implementing AI in debt recovery.

Here are the most pressing challenges in implementing a data-driven approach in debt collection today and how Flow is overcoming them.

It’s hard to build effective predictive models with limited data

Building an AI-powered solution can be frustrating when you don’t have enough data. As data is at the center of every AI project, scarcity can lead to inferior predictive models. Yet many debt collection agencies trying to develop data-driven solutions face this problem. That’s because the agencies usually receive only a snapshot of the borrower’s profile instead of clients’ full financial and banking history.

Debt collection can be more effective if there’s a clear view of the borrower. But that becomes a challenge when the data is limited. Further, it’s even more challenging to build a scalable model when data is scare. In Flow, we overcome the data scarcity problem by using small, standard set of data sources that all clients readily share to enable effective behavior analysis and predictive modeling.

Privacy concerns create obstacles to adopting AI-powered solutions

The landmark European data protection law, GDPR, illustrates the importance of privacy-preserving data management and shows the high costs of poor privacy controls. But the tightening data privacy controls may come as obstacles to some AI projects. For example, privacy concerns can limit how data is collected, hampering data analysis, and modeling to generate valuable knowledge to guide business execution.

Many debt collection agencies adopting tech-driven solutions now have to operate in restricted data environments. For example, clients want them to manage the personal data they receive carefully, mostly in line with privacy laws and sometimes in line with the client’s internal policy. Further frustrating data-driven modeling is that in some countries, data is not allowed across the borders.

In Flow, we figured out how to navigate the data privacy and security concerns to make AI applications for the debt collection industry easy even in the rapidly changing and fragmented data regulation environment. For example, Flow provides options to transform data to achieve the right balance between privacy and utility.

Additionally, Flow provides a library of components from which different AI applications can be composed. It includes model training, validation, and execution capabilities for different algorithms to work in the production environment in each country. We make it possible to manage the data modeling process at the country level with options to provide privacy measurement to remain compliant.

Semantics get in the way of developing effective data-driven data collection tools

When semantics are introduced too early in the modeling process, they can propagate errors downstream and limit the iterative improvement of model performance. Often, we want to label the borrowers based on their profile data. The accuracy of such a feature is impossible to measure and defend, without any ground truth data. Worse, any prediction errors and associated semantics are propagated into subsequent models. Therefore, it’s essential to focus on the scalable feature engineering process.

Flow has eliminated this problem. First, it uses unsupervised approaches to extract features. Second, its algorithm extracts a standard but rich set of mathematically objective features and reflects observable behavior.

Flow AI Engine: Making debt collection more efficient, scalable, and smart with data-driven solutions

At Flow, we build our AI-powered platforms following design principles that make debt collection not just more efficient and scalable but also smart enough to continue improving over time.

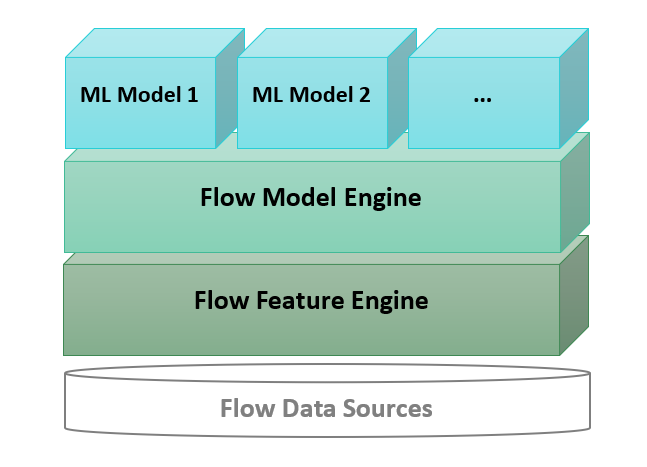

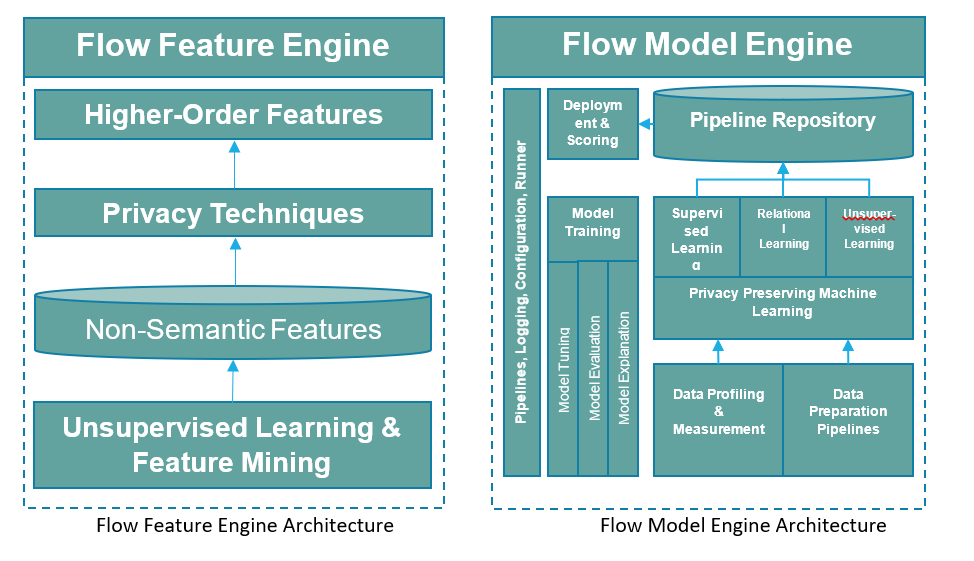

The figure above illustrates our high-level Flow AI Engine architecture. The AI engines enable machine learning applications to be easily built and deployed at scale.

Flow Feature Engine automatically computes thousands of useful yet privacy-friendly features reflecting borrowers’ online and offline behavior, focusing on communication behavior.

Flow Model Engine provides a powerful platform for building and deploying machine learning pipelines, with enterprise-grade capabilities like automated machine learning and model explanation.

Machine learning applications will be built on top of the Flow Model Engine based on the actual requirements and business needs.

Flow Feature Engine provides the ability to scale at the country level and with different clients or partners. It simplifies data requirements, eliminates feature customization, and accelerates model training for AI products with a rich library of standard features.

Instead of creating “obvious” features that are often difficult to predict, it generates unique features at first glance but straightforward to compute and no less predictive of the real target behaviors.

Flow Model Engine provides a library of components from which different AI applications can be composed. It includes model training, validation, and execution capabilities for different classes of algorithms, to work in production at scale.

What do you get when you choose Flow for AI-powered debt collection solutions?

Humans make mistakes which can be costly if they affect compliance. The right AI automation tools will eliminate human errors and biases in decision making while improving collection yields.

There’s no doubt that predictive analysis and modeling is the future of efficient and effective debt collection industry. The solutions to the challenges the industry presently face can be found in the data available. Indeed, the idea behind AI and machine learning is to obtain knowledge from data to enable businesses to make better decisions.

Debt collection agencies and lenders turn to AI-powered tools to extract additional knowledge from existing data and make processes faster, more efficient, and compliant at lower costs. For example, teams can focus early on borrower accounts that are more likely to repay, ensuring a higher recovery rate.

With AI-powered tools, the debt collection industry can quickly and easily determine the right contact channels to use with specific accounts. Smart digital tools will further help an agency understand when particular channels work the best to ensure more efficient debt recovery. The right AI tools will enable a debt collection agency to obtain more value from the data they already have.

To stay compliant and effective amid the changing regulatory environment and customer preferences, it helps choose the right AI tools for debt collection operations. With help from Flow AI Engines, we can deploy our prediction models into individual countries operating in compliance with the local data security and privacy regulations. It also enables us to practice our Build-Measure-Learn interactions better much more efficiently.

International (EN)

International (EN) Indonesia (ID)

Indonesia (ID) India (EN)

India (EN)