Whether it was the Asian currency crisis in 1997-98, 2008 global financial crisis or the current COVID-19 pandemic, such calamities cause a surge in distressed assets. Distressed assets are assets which are unable to service interest and principal for more than 180 days and subsequently become delinquent. They are inversely proportional to economic growth such that as an economy slows down, distress assets increase. These assets act as a drag in the financial institutions’ balance sheet because instead of generating income, these assets only end up consuming additional capital.

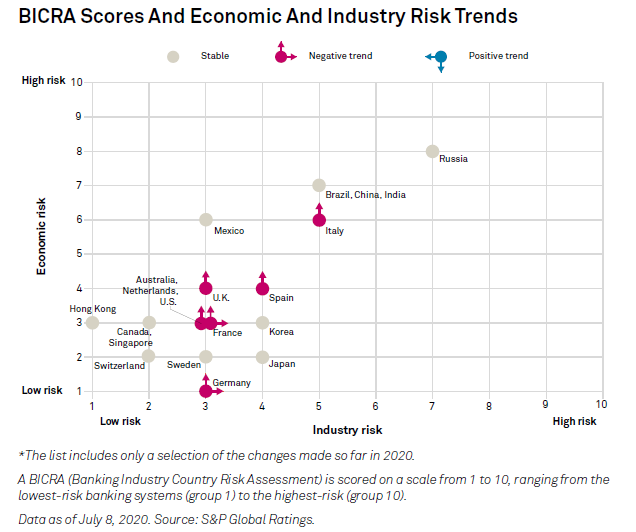

Given the current turmoil, volatility in financial markets, geo-political tensions and slowdown in the world economy, the industry as well as economic risks have increased. This is likely to impede the growth and increase the Non-performing loan (NPL) books of banks across countries. As per S&P, BICRA (Banking Industry Country Risk Assessment) has deteriorated for most of the countries.

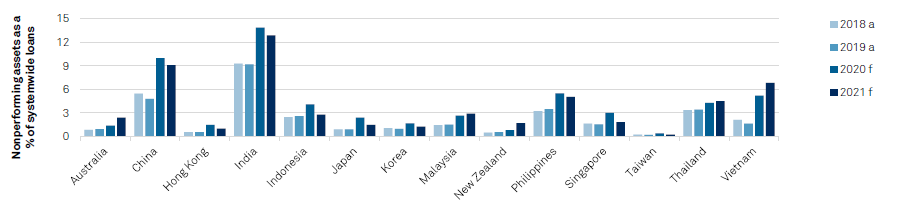

Given the current stressed conditions, this risk will not be restricted to a particular bank or a nation or a particular asset class but will be spread across. This can further be substantiated by S&P projection for NPL book of banks (refer chart below).

his high default rate is likely to increase bankruptcies and panic selling. While this is not one of the best scenarios for the banks, however, this has opened up a market opportunity for distressed debt investors.

Current trend of distressed sales

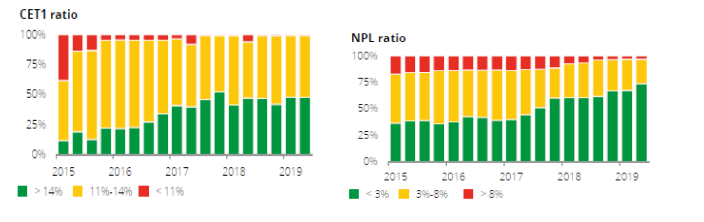

Post 2008 global financial crisis, the European banks were under huge stress with very high NPL ratios. This had led to the emergence of a new process of distressed loan sales which has eventually evolved over the last 10 years. According to European Banking Authority data, European banks have off-loaded nearly half of their NPL stock, cutting it to €636 billion as of June 30, 2019, from €1.15 trillion as of June-end 2015.

Benefits of developing a Distressed Assets Market

There are numerous benefits to a well-functioning and vibrant distressed assets market:

1. For banks and FIs: Maintaining a high level of NPLs ties up an institution’s capital in non-performing assets, putting pressure on long-term profitability and making it harder to absorb future losses and strengthen capital buffers. In addition, large NPL portfolios force banks to retain higher levels of capital, reducing their ability to provide new credit, which in turn can hinder economic growth as potentially good investments are postponed or abandoned. Furthermore, NPLs are more expensive to manage in terms of time and resources, which also affects the banks efficiency and profitability.

2. From a policy standpoint: A developed distressed assets market provides for an efficient and effective process for cleaning up banks’ balance sheets, as it allows for the disposal of NPLs to private investors who bring greater efficiency, expertise, and financing to the workout process.

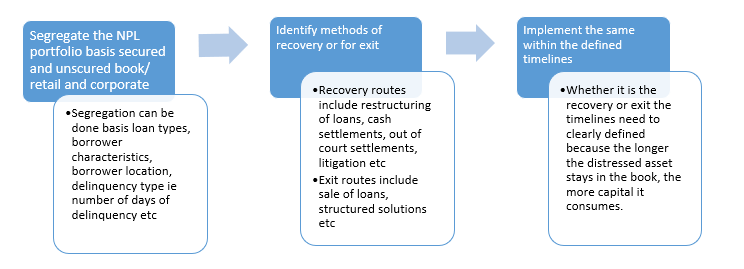

Developing strategies for management of NPL loans

Banks/ FIs need to address their NPL problems by developing a detailed strategy for its supervision. This includes the following steps:

Portfolio selection criteria

Now that the strategy for NPL management has been developed, banks and FIs need to identify the portfolio which needs to be sold. Going by current regulations, banks and FIs have been allowed to sell any kind of distressed assets like secured or unsecured, consumer loans or corporate loans, however, it is a difficult task to identify which loans to sell. Thus a criteria dependent on following factors can be developed:

· Collection strategy– For eg: Banks decide to collect all the NPLs which are less than 360 days and beyond that to outsource or sell the same. Another strategy can be that retail loans will be sold to third parties and corporate loans to be managed internally.

· Portfolio Pricing– how and what is the right and fair pricing for each portfolio. How will that pricing be determined? Due to the greater difficulty of evaluating the price of unsecured portfolio, by partnering with third parties in a transparent fashion, there are many options of portfolio sale, some including receiving a fixed price with some potential upside if recoveries are beyond a certain level.

· Bank’s internal strategy and risk appetite– depends on the staff strength, their expertise and stakeholders preferences.

· Operational and cost challenges– cost benefit analysis to determine which is better- selling or owning (self-collecting) the portfolio and type of portfolio to be sold

· Market demand / investor’s interest– is the market available for the decided sale

Why it makes sense to exit the Distressed Assets of Unsecured Consumer Loans?

While selling the secured portfolios is clearer as it is easier to evaluate the discounted price of the collateral, considering all the above criteria it has been mostly seen that to sell the unsecured consumer loan asset book has its own benefits.

1. Require Lesser documentation

2. No need for collateral evaluation/ valuation

3. Lesser regulatory hurdles and compliance

4. Quicker processing due to reduced documentation and operations

5. No / minimal Barriers for asset transfers

6. Easier due-diligence process

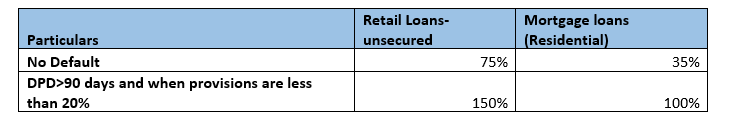

Further, it may be noted that unsecured loans have higher assigned risk weights as compared to secured loans and they end up in absorbing more capital (Referring to the table made below based on BIS Guidelines for Risk Provisioning, Dec 2019. Here we are assuming that the loan portfolio is equal and state of portfolio is same, then risk weights will be higher for unsecured loans than secured loans).

Thus selling the unsecured portfolio results in release of higher capital as compared to secured portfolio.

Why unsecured distressed loans should be sold to third parties?

Unsecured loans comprise of a number of small loans which are spread across geographies and borrowers. The follow-up and collection of these loans require extensive follow-up and mostly a call centre type set-up. At a bank or FI level, these loans require lot of time, human resource and manpower to resolve without providing adequate or sufficient return. Further, in case the recovery rates fell below a certain percentage, the bank or FI ends up losing profits instead of gaining from their internal collection processes. Alternatively, instead of deploying and choking their own bandwidths, banks have an option to sell the same to third party vendors or debt investors who are experts in the same. However, it can get daunting for banks to determine the right sales price especially for the unsecured portfolio. Some strategies that bank can use in determining the correct pricing are as follows:

1) Classic auctioning– increases the chance to get the best price (real-time auction or auction of closed envelops – both works well)

2) Right NPL management strategy to minimize risks banks may decide to collect inhouse all fresh delinquencies (DPD<60-90), outsource everything DPD 60-360, sell all after DPD>360

3) Older the portfolio, lower the price: find the balance between discounted Cash Flow from the portfolio in the next 8-12 months and ROI on the same amount if it had been invested now.

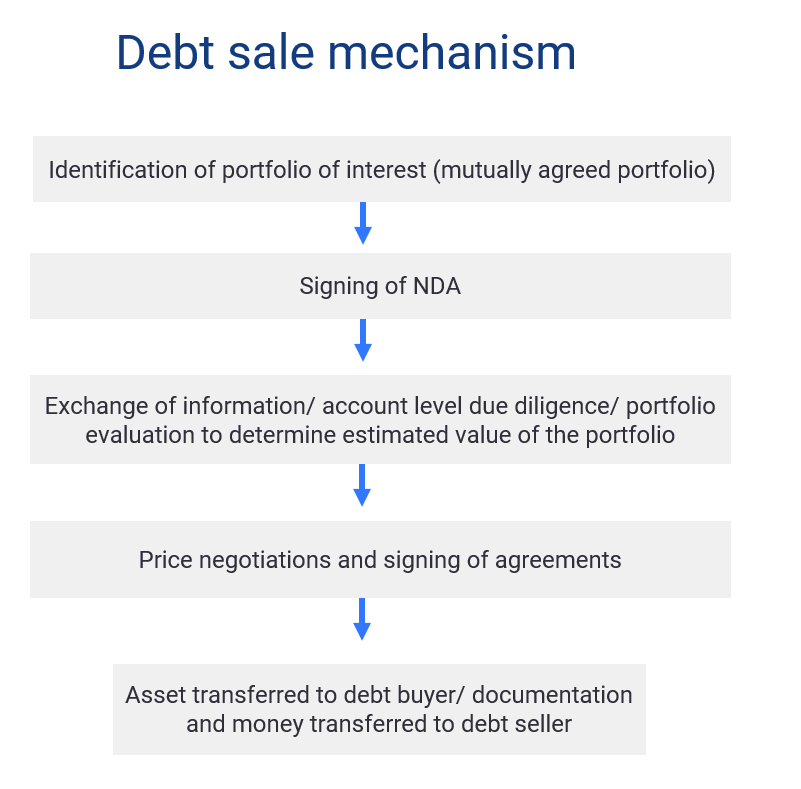

Mechanism for Debt Sales of distressed retail loans

Now that the portfolio for sales and an approximate right pricing has been discovered, banks need to follow the following mechanism for final process of actual sale of distressed unsecured loans portfolio.

The distressed asset market in Asia

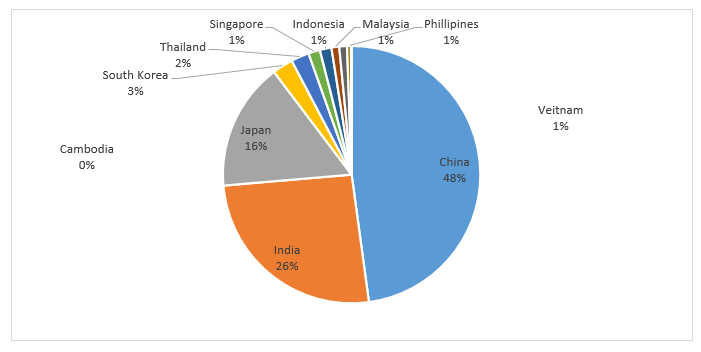

While European markets use sale of distressed loans regularly, the Asian market is catching up gradually. The NPL book of Asian banks stood at US$640 bn at the end of 2018 having increased by 23% over 2017, however the secondary sales for distressed assets in these markets is substantially low. The biggest markets in this region includes India, China, Indonesia, etc out of which China and India hold 75% of the region’s NPL.

With such a large opportunity, the NPL resolution market is relatively underdeveloped with limited NPL resolution plans in place. However, off-late central banks have started recognising the gigantic problem and have started identifying various resolutions methods. With the tightening of central banks noose, banks have also started taking actions on defaulters by setting up separate dedicated NPL unit and collection departments and enforcing stringent legal measures. Countries like India have set up separate resolution cells like National Company’s Law Tribunal (NCLT) for quick resolutions.

However, in all these actionables what most of the banks have missed is a strong recovery plan of distressed retail portfolio which also forms a sizeable chunk of their overall advances. Thus while the focus on bulkier and lumpy loans has increased, a part of portfolio which is easier to handle and quicker to resolve is getting completely missed. Hence banks need to build their focus on the unsecured retail/ consumer loans portfolio which includes personal and credit card loans.

Conclusion

A well-developed distressed assets market is particularly important during financial crises. Investors can play a valuable role in economic recovery by addressing debt overhang and providing banks with a way to divest themselves of problem assets. As these assets are cleared from the financial system, recovery ensues, and lending and job creation can resume. However, despite these benefits, many economies around the world still lack a functioning secondary market for distressed assets.

The Asian market for distressed loans is young and fragmented but has huge potential to grow given the huge amount of existing and expected NPLs. The process of balance sheet optimization to conserve capital banks have limited options. One of the quickest alternatives available is disposal of non-core assets. Banks can dispose of their delinquent assets by accelerating and starting with the easier and quicker option of sales of unsecured distressed consumer assets.

International (EN)

International (EN) Indonesia (ID)

Indonesia (ID) Tieng Viet (VN)

Tieng Viet (VN) India (EN)

India (EN)