Innovation in the development of financial products and services has been the driving force behind growth in the global financial system. Unlike in the past, financial institutions are increasingly curating financial products and services to target a unique subset of the population that has remained untapped for decades. Financial inclusivity has since emerged as a central theme, especially in developing countries where access to financial services and products has always been a problem.

As the World Bank notes on its website, financial inclusivity ensures easy access to useful and affordable financial products and services. Likewise, players in the South East Asia financial sector are increasingly exploring ways to narrow the gap between those who have access to formal financial services and those who have been left out over the years.

They are doing so by ensuring easy access to transaction accounts with zero barriers. Transaction accounts not only allow people to store money, send, and receive payments but acts as a gateway for other financial services.

The admission that the future of finance is brightest when financial services are offered to the broadest swath of the society promises to be a game-changer in the race to enhance financial inclusion. Easy access to financial products and services should help families and businesses in marginalized communities plan for everything, from long term goals to unexpected emergencies.

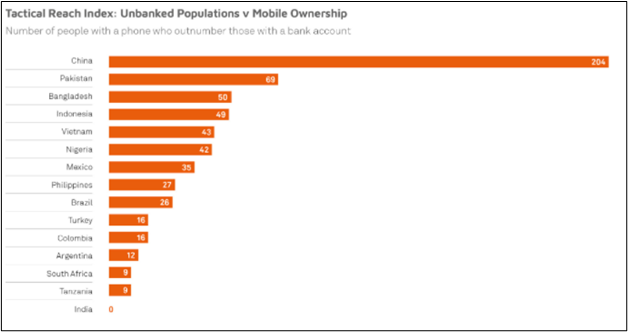

Source: Mastercard Newsroom

Great strides have been made towards financial inclusion. Since 2011, 1.2 billion people worldwide have gotten access to financial accounts. As it stands, 69% of adults have an account.

What could be the reason behind 31% of the global population lagging behind in access to financial services?

Financial Illiteracy as a Barrier to Financial Inclusion

In some parts of the world, it is not that the financial services and products are not readily available, but people don’t understand them and why they need them. Conversely, financial illiteracy is proving to be one of the barriers to financial inclusion.

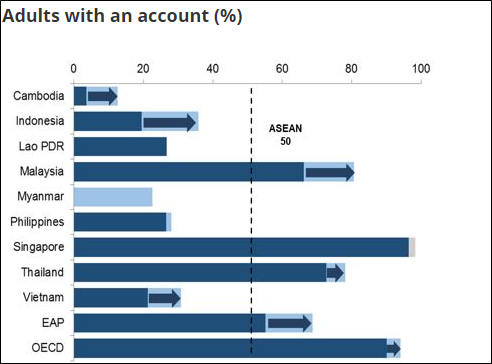

Source: World Bank Blogs

Source: World Bank Blogs

In Indonesia, for instance, low financial literacy levels have made it difficult for fintech companies to reach the market and have the desired impact. As is the case in Indonesia, financial illiteracy is a big problem in vast South East Asia.

In some parts of South East Asia, access to financial information, let alone financial services, is still a big challenge. Only a quarter of adults in the region are financially literate, with the Philippines, Vietnam, and Cambodia having the worst financial literacy results.

The lack of financial education has made it difficult for people in the worst affected countries to take advantage of their disposable income in a healthy fashion, thus the elevated poverty levels.

Debt & Poverty: Trapped by Peer-to-Peer (P2P) Lending in Asia

Financial Illiteracy has been the catalysts behind the thriving unethical loan business that has continued to impoverish societies in the region. The lack of financial literacy has seen people in developing countries enter into unimaginable binding agreements, some of which can never be repaid. The situation has been complicated by the fact that most people taking these loans lack any financial literacy, let alone legal knowledge to know their rights.

The exorbitant interest rates demanded have all but made it impossible for the people to pay down the debt and escape the debt cycle. The lack of bargaining power has seen most people sign blank contracts that allow some unethical P2P lenders to increase and inflate loan sizes and interest rates as they wish. The result has been people being trapped in a cycle of debt where one borrows only to pay a debt and accrue yet another debt.

Addressing Financial Illiteracy

Concerned by the evident effects of low financial literacy, most Southeast Asian governments have started to act. There has been an admission that improving financial literacy education is the only way to set the people for success conversely enhance financial inclusion.

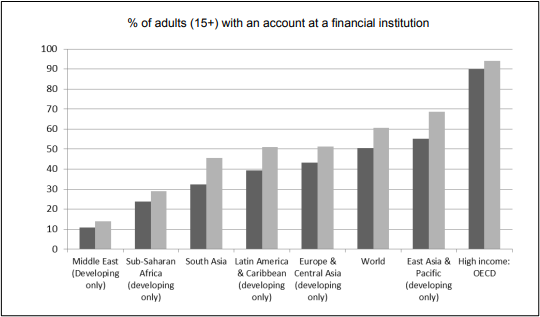

Source: OECD Publishing

Source: OECD Publishing

Likewise, financial literacy programs are increasingly being integrated into education systems while also targeting various populations. Governments and non-profit organizations are increasingly holding campaigns and offering programs geared towards enhancing the financial literacy among the urban uneducated, female, and the unemployed.

Enhancing internet access to the remotest part of the region has come into play in a bid to enhance access to financial information. In Indonesia, for instance, the Palapa Ring Project is encouraging more financial inclusion with internet access. Tokopedia is another platform that is doing a lot in enhancing financial literacy. The e-commerce platform has launched Rabu Nabbing, a savings campaign that seeks to enhance better financial management skills among people.

Amid the efforts, there are still calls to do more. For instance, there is a need to develop financial programs that target specific subgroups and regions to tackle distinctive needs. Similarly, there are calls to introduce financial education lessons in all primary and secondary school curriculum.

Importance of Financial Inclusion in Developing Asian Countries

Enhancing financial literacy levels in developing countries goes a long way in enhancing financial inclusion. In most cases, the poorest and the vulnerable in society are able to understand the importance of financial services and how they can help them live a better life.

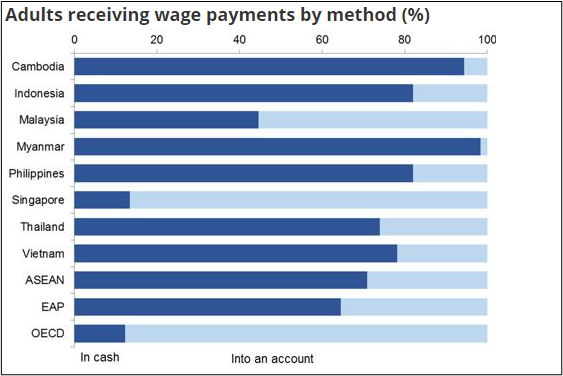

Source: World Bank Blogs

As more people look and gain access to financial services, better handling of money through budgeting becomes evident. In addition to developing communities, financial inclusion has the potential to drive economic growth in developing countries.

Financial inclusion is also proving to be an effective tool for empowering people and communities neglected and mistreated over the years. Likewise, it enables people to access skills for managing and saving money. In return, it empowers people to make the right financial decisions.

Future Trends in Financial Inclusion

Firstly, youth inclusion is poised to be a major policy priority as developing countries in Southeast Asia realize the full benefits of financial inclusion. The youth account for a significant portion of the population in the region. Likewise, most of them will need to have easy access to financial services and products to facilitate entrepreneurship and employment options to boost local economies.

The lack of digital identity solutions has also been one of the barriers to financial inclusion. In the race to ensure easy access to financial products and services, expect digital identity solutions to crop up, thus ensure financial institutions don’t have a reason to exclude vulnerable populations when it comes to financial services.

Likewise, in Flow, we are committed to help borrowers to overcome their financial difficulties through ethical and AI-enabled collection strategies and systems that include educating consumers on loans and debt management. We also strongly believe that ethical lending has significant impact on a borrower’s indebtedness and strictly only work with ethical lenders. Debt collection issues can be challenging and stressful. We are constantly looking out for opportunities to promote responsible collection and financial inclusion to empower consumers in underserved economies.

International (EN)

International (EN) Indonesia (ID)

Indonesia (ID) India (EN)

India (EN)