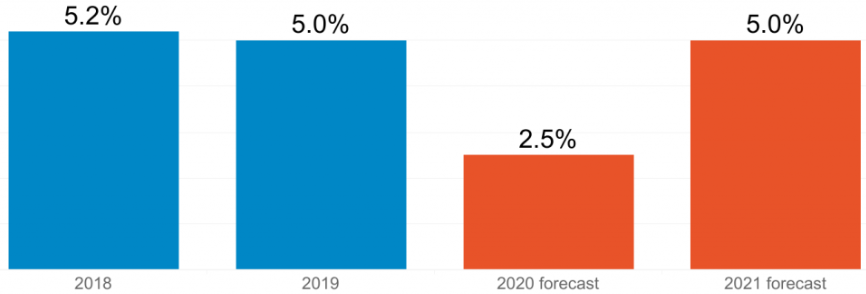

In 2019, the World Economic Forum (WEF) declared that the dawn of the Asia century was underway. On a different occasion, WEF noted that the GDP of the entire Asian continent would surpass that of the rest of the world. The middle class was growing, and customer profiles and behaviors were changing fast. For individual countries like Indonesia, the economic picture was rosy. In the last two years, Indonesia’s economy expanded at comfortable rates slightly above 5%.

Figure 1 Indonesia GDP Growth Forecasts. Source: Asian Development Bank.

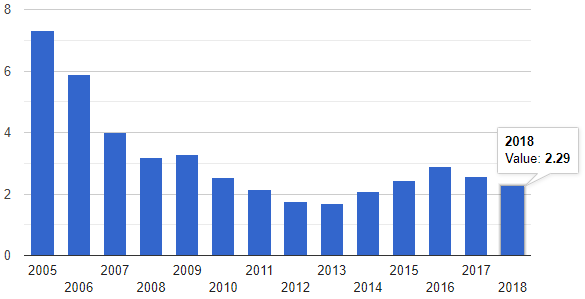

Since the COVID-19 pandemic struck, Indonesia is facing a different reality. According to the Asian Development Bank (ADB) estimation, Indonesia’s economy could grow by 2.5% in 2020. However, this growth is dependent on the nature of the pandemic for the second half of the year. In the past few years, Indonesia financial sector has dramatically improved in terms of the ratio of non-performing loans (NPL). By 2018, the ratio of NPLs was down to the pre-2011-2015 recession of under 3%, at 2.29%. Nevertheless, the trend is most likely to reverse upwards, given the effects of the pandemic.

Figure 2 Indonesia – Non-Performing Loans. Source: TheGlobalEconomy.com.

Indonesia’s government moved with speed to shield the entire economy from the sudden stop in economic activity. Notably, the parliament passed Perppu 1/2020, a law allowing government agencies to deploy all tools necessary to mitigate COVID-19 effects. Besides the Perppu, Bank Indonesia (the Central Bank) allowed banks to operate with lower mandatory statutory reserves. Additionally, the Financial Services Agency (OJK) introduced certain relaxations when assessing banks’ NPLs. To bolster the capital stance for commercial banks, Bank Indonesia began to extend loans to corporations and banks on favourable terms.

The current state of Indonesia’s retail loan market

Indonesia’s retail loan market consists of commercial banks, multi-finance institutions and FinTechs. Banks dominate this sector, but Fintech lenders are increasingly stepping up their game. In light of the disruptions to economic activities, the government implemented Perppu 1/2020 alongside a slew of initiatives to enable banks to continue lending. However, the heightened risk of non-performing loans has pushed the banks to put a huge price on credit.

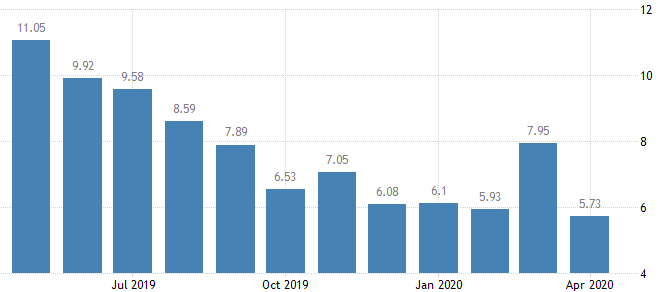

Because of this, fewer consumers are taking up loans. Pre-COVID-19, Bank Indonesia, and OJK had expected lending to grow by about 11% in 2020. The increased risk of NPLs has pushed the two institutions to downgrade the growth to between 6% and 8%. In terms of the cost of credit, this year is about to witness an enormous growth. Before the pandemic, Standard and Poor’s (S&P Global) rating agency projected the cost of credit in Indonesia to grow by 185 basis points (bps). Due to the overwhelming nature of the pandemic, S&P Global has revised the projected cost of credit to 285 bps.

Loan restructuring helps to reduce banks’ NPLs

The government’s intention to intervene in the credit market via Perppu was announced in March. As mentioned earlier, the law allows commercial banks to operate with lower levels of statutory reserves and credit from Bank Indonesia at cheap rates. In the same month, the value of loans in Indonesia grew by 7.95%.

Figure 3 Indonesia Loan Growth. Source: TradingEconomics.com.

Nevertheless, new loan growth seems to encounter problems with demand. While the government has facilitated commercial banks to provide cheaper loans, it looks Indonesians’ uptake of credit is stalling. According to Bank Indonesia’s Banking Survey for April, consumers demanded just 23.7% in loans in Q1 2020. Comparatively, the demand for loans in Q1 2019 reached 70.6%. Respondents in the survey identified the slump in economic activity as the key reason behind the low credit demand. Besides, the credit rating of many Indonesians has been undermined by the sudden stop in economic activity.

Fintech P2P lenders see a sharp increase in loan requests

One would imagine that the declining demand for credit from banks represents falling demand across the board. On the contrary, the Fintech space has encountered a deluge of loan requests since the onset of the pandemic. The majority of the people are those on unpaid leave and self-employed workers. Such consumers cannot make it the creditworthiness net used by commercial banks. Some peer-to-peer lending platforms have recorded 40% more loan applications by late March.

But just under two months later, the Fintech sector is struggling with a pile of risky loans. Unlike commercial banks, many P2P lending platforms could not implement the loan restructuring requests from borrowers as allowed by Perppu 1/2020. Particularly, 88 such platforms granted only 34% of 1.96 million applications for loan restructuring in May alone, according to Indonesian Fintech Lenders Association data.

According to industry insiders, lenders are using historical loan repayment data to manage loan-restructuring requests. For instance, borrowers who had a history of defaulting before COVID-9 pandemic are unlikely to get their applications granted. Overall, Fintech P2P lenders’ NPL ratio is climbing dangerously. OJK data shows a relentless march upwards for NPL ratio since January, which was at 4.22% in March, 3.93% in February, and 3.98% in January.

The outlook of Indonesia’s retail loan market

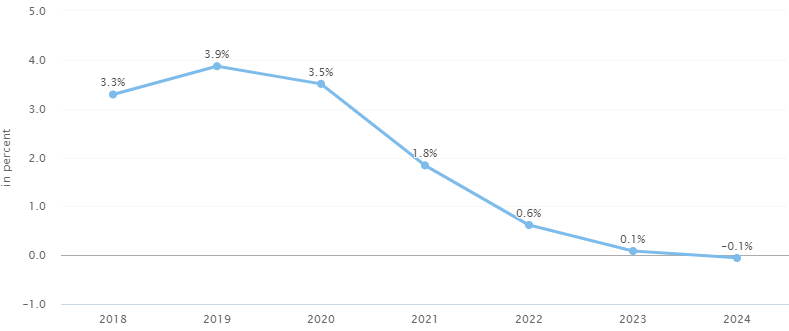

The credit market in Indonesia is unlikely to show much difference in the future relative to the current scenario. If anything, consumer lending is likely to worsen in the coming months. The transaction value in Indonesia’s consumer lending market is projected to clock IDR 113.67 billion (US$ 8.0 million) by the end of 2020, Statista data shows. The impact of COVID-19 on the retail loan market is massive, and the market might never recover in five years. Interestingly, Statista projects that transaction value growth might sink into negative territory by 2024.

Figure 4 Transaction Value Growth In Consumer Lending In Consumer Lending In Indonesia. Source: Statista.

In the previous Banking Survey (done before COVID-19), respondents had predicted that the credit market would grow at 9.4% year-on-year in 2020. However, Bank Indonesia reported in April in a fresh Banking Survey (cited above) that the prediction is much lower at 5.5% y-o-y due to the pandemic. Perhaps, the survey found, the situation might change if banks implement a looser lending policy. It will depend on the willingness of Bank Indonesia and OJK to initiate bolder stimulus packages for the country’s financial industry.

On the other hand, the future of Fintech P2P lenders rests almost entirely on the course of the pandemic. If the pandemic drags on and Indonesia’s economic activity fails to unfold as planned, then the FinTechs are facing a possibility of even taller piles of risky loans. Besides, requests for loans on P2P lending platforms could decline if banks loosen their lending policy.

The way forward for Indonesia’s loan market

For commercial banks, more loan restructuring will reduce the share of NPLs from their books. These institutions ca restructure most of their loans because of the history of the strict lending policy. Also, Perppu 1/2020 gives Bank Indonesia and OJK latitude to deploy every necessary tool to mitigate COVID-19’s impact. This way, one can be confident that more initiatives by the government agencies will allow more wiggle room for commercial banks in dealing with NPLs.

Fintech P2P lending platforms, however, look like they have a date with destiny. The platforms’ non-performing assets (NPAs) have only one way to go upward. It is true unless they increase the acceptance rate of loan restructuring requests. Additionally, the platforms might need to implement innovative programs to facilitate borrowers. For instance, they could extend or eliminate fines due to late repayment of loans. Furthermore, OJK could help the P2P lending platforms to sail through this storm by raising the funding limit.

The COVID-19 pandemic has rendered most, if not all, traditional collection strategies in Indonesia ineffective. Be aggressive, and you will lose all your clients because few alternatives exist. What then should creditors do?

Implement loan restructurings

Undoubtedly, many Indonesian borrowers will default if the pandemic drags on. In this case, lenders have limited options in terms of what collection strategies they can implement. Thankfully, the government has been supportive in a way that encourages lenders to facilitate their borrowers. A way forward that could be effective right now is to restructure as many loans as possible. This way, lenders can increase the probability of redeeming the assets and can retain the customers post-crisis.

Utilise third-party collectors

Few lenders were prepared for this crisis when it comes to collection strategies. Instead, the majority were looking for opportunities to expand their reach. On the contrary, third party collectors spend their entire life looking for effective collection strategies under different scenarios, including dire ones like the current crisis. It could be helpful, therefore, for lenders to outsource collection activities to such entities that operate digitally and in-depth understanding of different types of borrowers.

Recovery from this pandemic

Indonesia’s economy is facing a double tragedy. On the one hand, the COVID-19 pandemic has stalled economic activity in the country resulting in income losses on a massive scale. On the other hand, neighboring countries that are the market for Indonesia’s commodities and minerals are in the same situation as Indonesia. Therefore, exports are not moving as usual. Cumulatively, the credit market, especially the retail loan market, is facing a dire situation.

Nonetheless, the government is willing and ready to mitigate the pandemic’s impact via various initiatives that are already underway. As a result, lenders such as banks are restructuring loans to improve their books’ NPL ratio. Fintech P2P lenders, on the other hand, need more support in the form of a raised funding limit. In addition, the P2P lending platforms have no otherwise but to up the acceptance rate of loan restructuring requests.

International (EN)

International (EN) Indonesia (ID)

Indonesia (ID) India (EN)

India (EN)