In November last year, Bloomberg started to rank geopolitical regions based on their handling of the Covid-19 pandemic. According to the latest rankings (released on April 26), the Asia Pacific (APAC) region is the best performer. The region received the high rating largely because of a vaccination campaign that is so far successful.

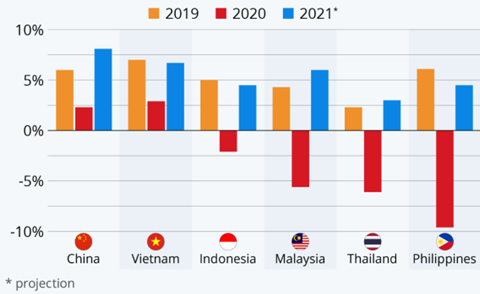

The majority of Asian nations implemented policies to shield the populace from the impacts of the recession. Nevertheless, many countries in the region recorded massive dips in economic activity, as did the rest of the world. For example, the economy of the Philippines contracted by nearly 10%.

The International Monetary Fund (IMF) and the Asian Development Bank (ADB) predict an economic rebound in Asia. The ADB forecasts a recovery of about 7% in 2021. On the other hand, the IMF expects a “multispeed recovery in Asia.”

There seems to be a consensus that Asia will come out of the pandemic-led recession stronger. But the recovery does not take away the reality of the damage that the pandemic is leaving behind. A recent report by The Banker sheds light on the status of non-performing loans in Southeast Asia. During the pandemic, banks and other financial institutions put in place forbearance measures. However, the forbearance periods across the regions are lapsing, and a crisis of NPLs is beginning to unfold.

NPLs expose the vulnerabilities of borrowers

Various media reports are peddling economic recovery figures that show Asia as a resilient region, but the state of NPLs cast a different light on the area. The primary theme of The Banker report is that unemployment rates are on the uptick, so is the poverty rate. Borrowers are no longer able to honor debts assumed pre-pandemic because they lack an income.

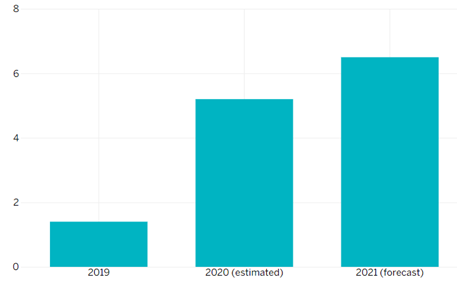

For example, NPLs in Vietnam shot to 5.2% in 2020 compared to 1.4% in 2019. Estimates show that the NPLs will further increase to 6.5% in 2021 despite Vietnam’s speedy recovery. The Vietnamese case is a representative sample of what is happening in many countries in the region. Borrowers are having to choose between starving to death and paying back debts.

How can lenders and collectors pursue their interests in light of the vulnerable customers?

Unemployment is a vulnerable circumstance for a borrower. Because of desperation, a customer in such a circumstance cannot make an informed decision. Step Change, a debt charity, defines a vulnerable customer as a person who cannot deal with debts for a reason or the other.

The ability to handle vulnerable customers in the post-pandemic period could be the most in-demand skill among lenders and collectors. If you think about it, the first step to dealing with vulnerable customers is not difficult. You only need to speak to them. This is the time to psyche up the call center team to bring their A-game concerning customer relations.

Lenders and collectors only have one way of knowing the reason why a borrower is delinquent – through speaking with them. However, customers in vulnerable circumstances are volatile, which calls for specific soft skills when handling them. The soft skills include empathizing with the customer and the ability to deescalate tense situations.

Why should lenders and collectors train operators to acquire the soft skills?

Borrowers should reimburse their loan amounts in total, and they know this very well. Do your operators have this knowledge? On this matter, there is no room for guesses. If you cannot ascertain that your operators appreciate your customers’ circumstances, you need to train them.

Adequate training of call center operators to handle vulnerable borrowers in a better way must follow a straightforward process. Lenders could begin by establishing a vulnerable borrower policy – a boilerplate of rules and expected outcomes. You can constantly adjust the approach to incorporate emerging issues.

A good vulnerable borrower policy has a process for spotting the target. For example, what characteristics identify a vulnerable borrower? Specific prompts should point the operator in the right direction. Using speech analytics technology, an operator could identify repetition as the customer speaks. Repetition could be a signal of a distressed customer.

What next after spotting the vulnerable borrower? The policy should include guidelines such as operators logging the details of each case in a centralized database. A unified database makes it easy for operators and other personnel to follow up on the issues. Also, the recorded data helps to identify and decipher patterns. An artificial intelligent software utilizing natural language processing techniques could work out this task reasonably quickly.

Providing more empathy for a more effective recovery

Why do the training and development of an organizational policy? Structuring conversations with vulnerable borrowers improves customer experience. Also, well-trained operators are more effective and experience fewer frustrations while at their desks. Ultimately, the organization benefits through better retention of customers and increased collections.

International (EN)

International (EN) India (EN)

India (EN)