The past five years have witnessed the rise of FinTech companies and solutions which has led to a completely new and transformed financial services landscape. Some of the parameters driving the push for reinvention and innovation are factors such as changing customer expectations, cutthroat competition, increasing regulatory complexity, the pressure to streamline operations and the need to constantly upgrade to the dynamic consumer world.

Digital payments today is the main reason for thriving the global digital economy, with rising user base of smart phones, mobile/internet banking, e-commerce and improved internet penetration. The enhanced banking system today has enabled systems to integrate with new platforms and applications quickly and seamlessly. Physical banks and paper systems are quickly being replaced by robust networked digital ecosystems.

According to the research conducted by Gartner:

- At least 5 countries will launch digital initiatives to remove cash from circulation by 2023 fully replacing cash by digital means

- Global cash in circulation will reduce after decades of year-on-year increases by 2024

- Consumers using mobile proximity payment methods will be almost 2 billion, up from 2019’s figure of less than 1 billion, by 2024

Because of the above reasons, most of the lenders today are encouraging the digital acquisition model thereby reducing their operational cost and enhancing their customer experience. The traditional lenders who are hesitant to adapting to the digital acquisition model are facing a tough time in acquiring and nurturing a loyal customer.

Let us now understand the credit market behavior. Credit analysis determines the risk involved with a loan and its borrower. A bank or lending institution will check your business & personal financial details regardless of the type of financing needed. Credit analysis can be broken into the “5 Cs:” Character, capacity, condition, capital, and collateral.

Top Digital Transformational Trends in the Financial Services

Technology is driving trans-industry innovations that are streamlining traditional processes. With digitization in place, it is possible to bring in consistent efficiency, cost reduction and take customer service to a whole new level. Let’s look at the Let’s look at the top digital transformational trends in the financial services.

Digital transformation has become a top business priority:

68% of financial services companies have developed a digital transformation strategy vs. 63% of all organizations.

The way financial institutions now manage their activities and transactions has changed significantly over these years. Now let us understand the immense competition within the financial sector. The financial services sector now consists of thousands of new entrants of various revenue sizes and services. Therefore, it becomes an imperative for the existing companies to evolve themselves in order to be at par with these new entrants.

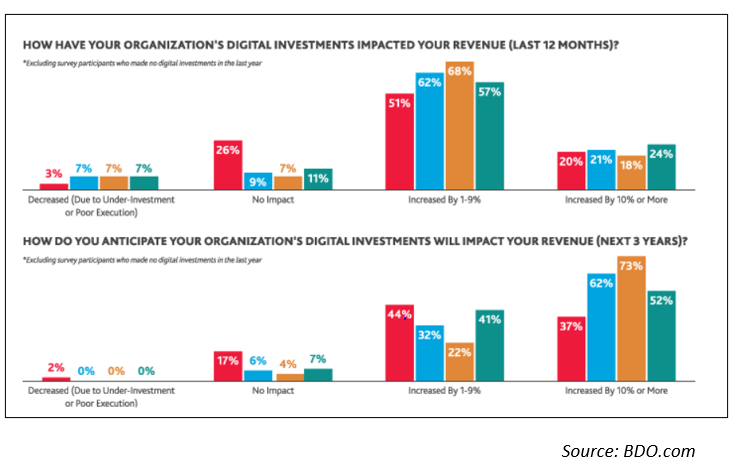

Digital transformation brings highly anticipated – ROI

Digital transformation has time and again shown efficient returns on revenue and profitability. One of the major benefits is elimination of paperwork and manual labour, thereby, improving customer experience with operational efficiency. Most financial service companies anticipate high returns on revenue and profitability from digital transformation – even more than those in other industries. Below is a graph (Source: BDO.com) showing the impact of digital investments on revenue and the responses taken by companies who implemented the same.

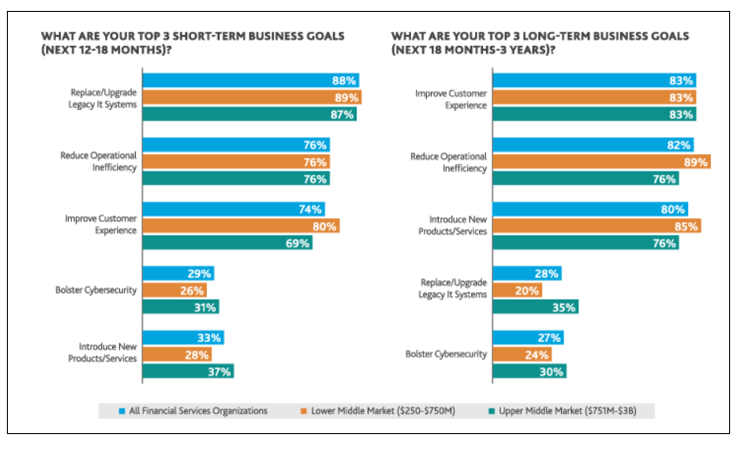

Short term and term long business goals: Improving customer experience

“Good customer experience”, a few decades ago, meant having a pleasant experience at a physical bank or other financial services firm. Today, it includes anything from being able to access an account from multiple channels, to getting a question immediately answered by a chatbot or robot advisor, to receiving automated real-time notifications on emails, etc. As a result, financial services companies ensure that their IT infrastructure’s capacity to integrate advanced technologies is always at par with what the industry requires.

Credit Management Today

Credit is sometimes granted too freely or without a clear assessment of the risks involved. Collections lapse past 90 days. Write-off’s balloon. Post charge off recoveries languish. Creditors often lack the predictive insight, seamless information, and flexible, performance-proven collection rules and treatment strategies needed to make dramatic improvements. But with digital transformation—a holistic approach combining dynamic organization, informed business models and advanced technology—this situation is starting to change. As a result, for banks and other financial institutions seeking to gain competitive advantage, increase credit revenues and retain valuable customer relationships, the persistent challenges of credit management are becoming unprecedented opportunities for expansion and growth.

In a global economy hooked on credit, credit management is more important than ever before. As banks and financial institutions work on transforming their credit management operations, getting it right means looking at the customer and merchant journey.

For the customer, the credit experience with a lender contains approval delays, demands for redundant information, loan offers that are simply not competitive. or lending rejections based on false or out-of-date data. In addition:

- Loan repayment mechanisms may be viewed as cumbersome, confusing, and easy to forget; or lack a self-service component.

- Collection efforts may be perceived as ill-informed, annoying, and even abusive. This is particularly true for a social media savvy generation, where failure to use a preferred communication channel for contacts is always one contact too many.

Therefore, lenders and creditors should ensure that the above are taken care of, for the borrower. At their end, they need to check point the below pointers to ensure a smooth functioning for themselves.

Digital-native lenders use technology to run businesses more efficiently than ever and offer improved customer interfaces. The best digital retail lending institutions often run operations at lower costs than their traditional competitors, in some instances achieving as much as 70% lower cost of origination, 60% lower costs on the front end, and 80% lower costs for middle- and back-office functions. However, there are many challenges that come along in this.

Challenges: It takes a solid foundation of effective and efficient processes to make a successful transformation

To grow and stay ahead of the curve, financial institutions need to address challenges arising from regulatory scrutiny, higher operating costs, unproductive legacy IT systems, emerging competition from non-banking firms, and changing customer behaviours. Some of the challenges are listed below:

- Limited metrics used to monitor the flow of information

- Insufficient training and workload management for staff

- Poor use of existing system functionality

- Data integrity issues throughout the process, causing a drag on sales volume

To tackle these challenges, the lenders need to streamline their lending processes from origination to maturation to make it easier to increase automation with cutting-edge technology. The first step is to review existing processes to pinpoint and eliminate inefficiencies and eliminate every challenge accordingly.

What the future technology beholds? Let us look at the few established technologies which already passed the proof-of-concept stage and would be beneficial to the credit industry.

- Use of biometric: The financial institutions have ensured that the payment wallets running on the mobile devices have successfully paved way of this method and good amount of research and development is happening in this area.

- Use of Voice/ Speech analytics and AI/ML algorithms: This will help create more secure and simple way to trade and transact within the digital payment domain, thereby improving the efficiency for the credit industry.

- Contactless: There are various credit card players who are already issuing the contactless that will work with ATMs and POS terminals and even interact with the mobile devices. Though it hasn’t reached every part of the world, especially the rural parts.

- DLTs: Digital Ledgers / Blockchains’ foray with digital currency is well known and is creating news as it is trying to find a balance between autonomous currencies and digital payments. This soon is expected to create revolution in the market.

International (EN)

International (EN) India (EN)

India (EN)