The evolution of technology in debt collection

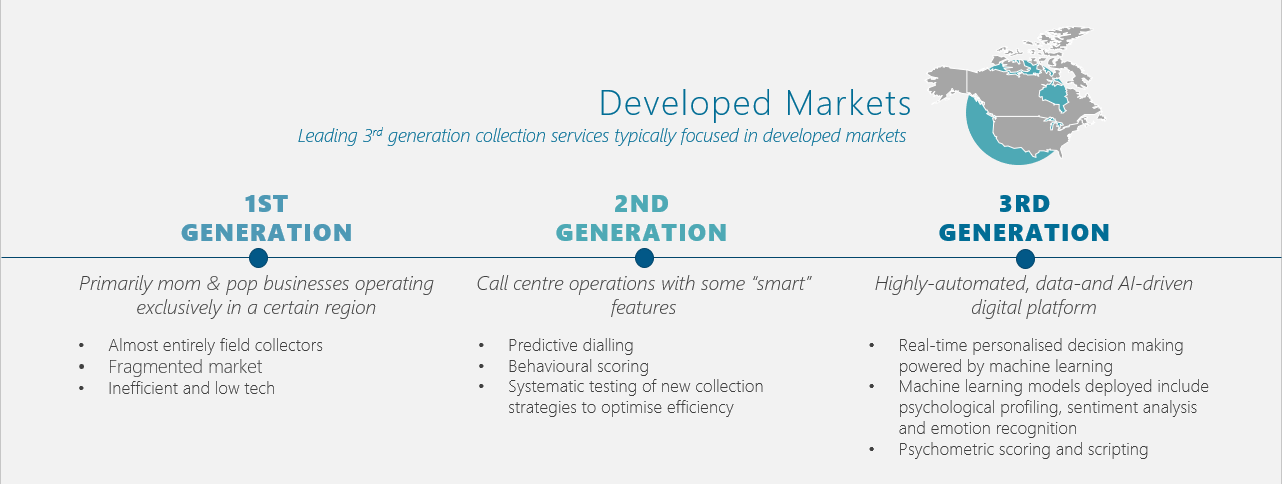

Technological advancement in the debt collection space may have progressed later than the other fields in Fintech such as lending and payment. However today, it is catching up fast in the developed markets and now to emerging Asian regions. We are starting to see automation and Artificial Intelligence (AI) being applied into the debt collections processes for a more seamless and nimble recovery. What was once a neglected industry dominated by field collectors, debt collection has become smarter, targeted and more effective than ever before.

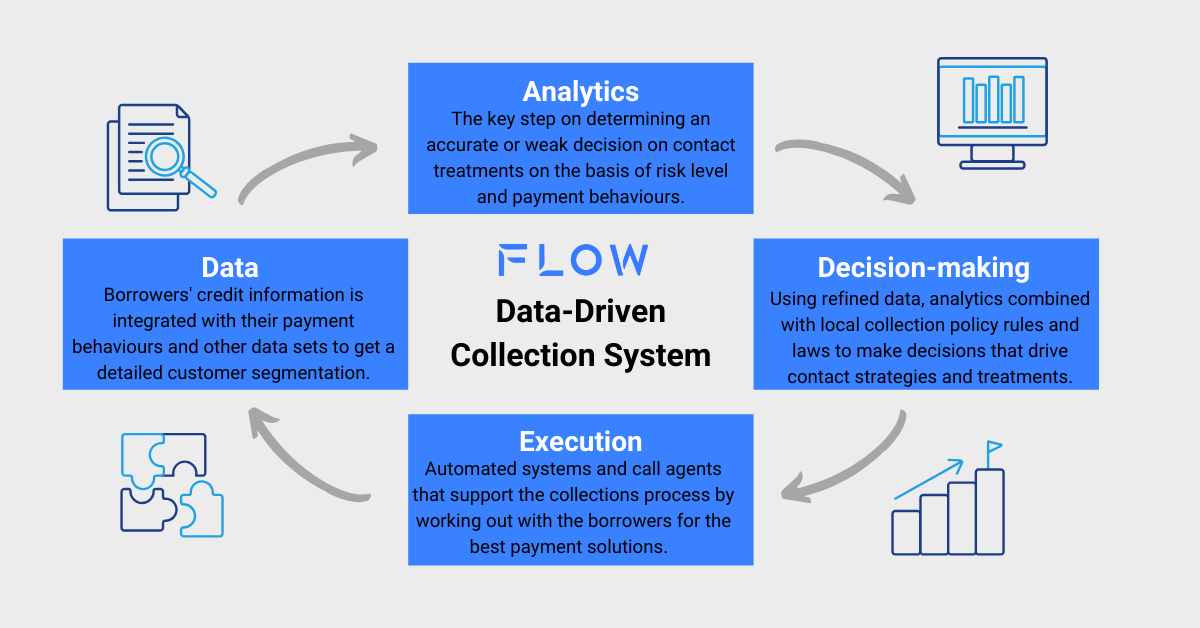

There is a growing need to take a more data-driven approach in collections- if you can’t measure it, you can’t improve it. The key goals for many lenders include to make more accurate predictions of account delinquency, how to effectively segment them based on their payment behaviours and risk levels, which contact to prioritise, and then using these knowledge to form the most appropriate collection strategies.

In traditional collection processes, financial institutions segregate borrowers into a few rigid risk categories classified by delinquency buckets and simple analytics before assigning collections teams accordingly. Lenders will keep records to anticipate which accounts will become delinquent and the effectiveness of their collection strategies. These efforts have been largely manual, requiring a huge investment of time and effort. While these methods were sufficient in the past, the current economic climate calls for more efficiency in debt collection.

The current economic landscape requires even greater efficiency for collection teams

The growing recession has seen a surge in Non-Performing Loans (NPLs). This increase in NPLs combined with the urgency to improve collections, has prompted financial institutions to use every tool available to update their current collection system and processes before more borrowers roll into the later delinquency buckets.

Furthermore, collections teams are facing enormous pressure to do more with less. Consumer preferences, resources cuts, pressure to reduce costs and complex regulation, have all forced financial institutions to adopt technology that allows them to be more efficient and adopt a personalised approach to collections.

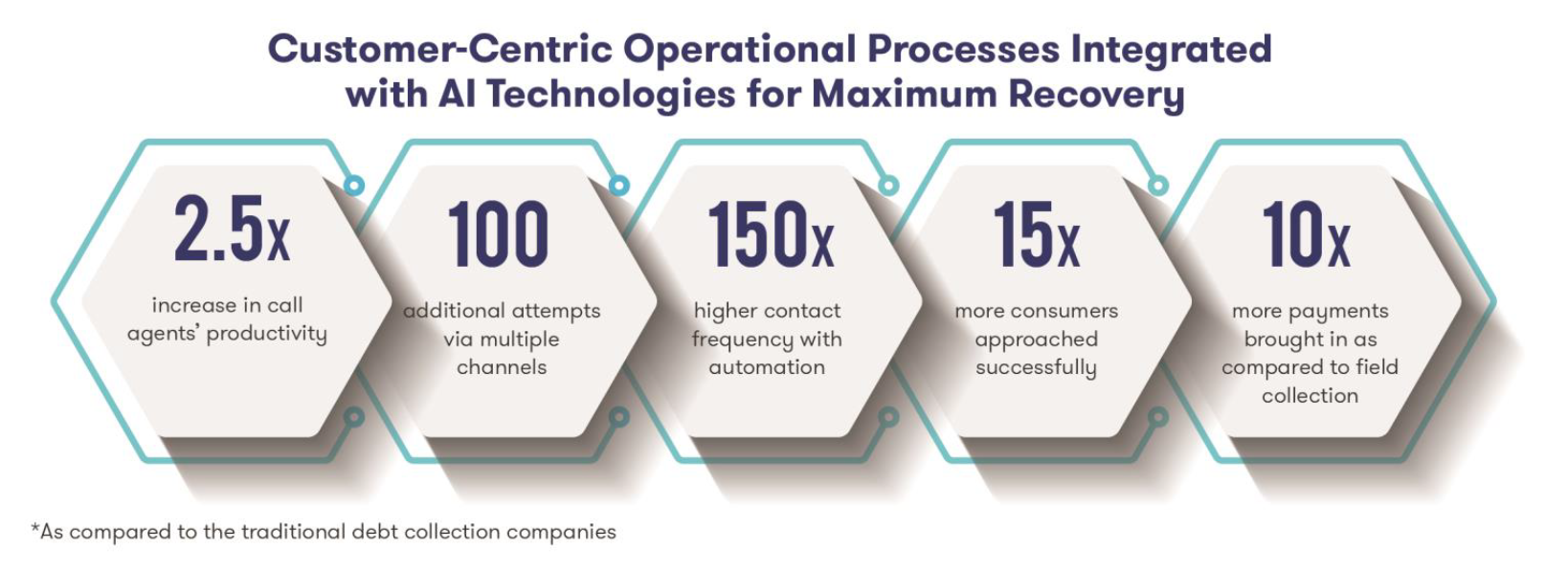

Technology could be the key financial institutions are looking for to reduce borrower handling time, simplify debt collection as well as meet regulatory requirements to minimise legal action and penalties. By applying technology, these financial institutions can improve outcomes and identify probable defaulters and this improved understanding allows them to apply data-driven strategies to improve collections and customer service. They can also get a better understanding of borrowers, scale operations efficiently with automation, negotiate with borrowers using data insights, stay updated on the status of delinquent accounts, facilitate payments, and carry out omni-channel communication efforts and activities.

The positive impact on debt recovery

Advanced analytics and machine learning are transforming collections to make it a more efficient operation to improve performance at lower costs. Advanced technology allows financial institutions to create more detailed consumer segmentation, which leads to them being more nuanced in their approach to at-risk borrowers. Furthermore, loss-forecasting strategies can be improved on, helping financial institutions be more accurate in their outreach.

Analytics and automation help managers shift their focus from protecting customer relationships to protecting assets, minimising losses and improving outcomes. Machine learning is also expanding the scope of what can be automated, which can help collectors be more concise in their work. For example, call operators will get more prescriptive decision support, more script elements to use, and narrow parameters for negotiations, freeing up resources for more critical work.

Have a tech-driven and customer-centric collection system to maximise your debt recovery

If financial institutions want to maximise debt recovery, they need to integrate customer-centric operations and advanced technology. Furthermore, data and technology cannot exist in silos, so banks and lenders must develop a system that integrates them both.

For example, consumer data is useful, but predictive analytics uses the data to inform decision-making about treatment and interactions. Automated systems are used to make decisions that drive customer interactions or treatments. Sophisticated tools and systems are important for communicating with borrowers:

1. Scale-up collection operations with automation

Technology can help financial institutions operate more efficiently. For example, IVRs can cover standard calls, freeing up the workload for call operators.

Automation can shift administrative and research-oriented work away from people. When administrative work is automated, it reduces errors and allows collectors to do more value-generating work.

Finally, there is the use of the smart collection platform. Banks and other money lenders can find the best way to communicate with borrowers. This includes selecting the right communication channel, like SMS or IVR – matching the communication channel with the right demographic is crucial for success, making the smart collection platform important.

2. Personalised communication strategies with machine learning for better accuracy

Since financial institutions store large volumes of data, AI and analytics can comb through all these records to build a system of personalised communication. Research by Emerji, shows that using AI in this way has proven to be incredibly effective.

Automatic Speech Recognition (ASR) combined with Natural Language Processing (NLP) models make it easier to analyse a conversation and convert it into actionable insight. With these two technologies, institutions can build a profile on each borrower to better understand their situation, paving the way for ethical treatment for borrowers.

Analysing records allows institutions to select the right communication channel, appropriate tone, time of day and frequency. This is important because custom messaging is seen as one of the most effective means of improving the repayment rate.

By investing in AI and data analytics, lenders can convert every signal into an asset to better understand the situation of borrowers. Finally, data points can be used to support the improvement of AI models. Furthermore, the data presents a lot of insight into the behavioural aspects of borrowers, which can be used to refine strategies even further.

3. Champion-challenger strategy as an iterative design tool for optimal outcomes

AI and data analytics are instrumental in selecting the optimal collections process. There are several ways to monitor collections and engage with the borrowers, but the ideal process is selected based on the champion/challenger model. The most effective process is deemed the champion with other options deemed the challenger. This approach plays a crucial role in iterative design and improvement.

Over time, the debt collection system will identify which communication strategy delivers the best return and which are lacking in results. If there is a challenger that outperforms the incumbent champion, then the challenger takes the place of the former champion.

4. Set quality control as a key function

Quality control is a huge concern for many financial institutions. Integrating technology into quality control unit enables greater transparency and the quantification of performance of non-traditional factors. Through speech-to-text recognition, sentiment analysis and psychological profiling, appropriate language and tone is used by call operators is ensured, hence improving customer relations, brand reputation and compliance rates through better communication.

AI and data analytics are crucial for improving communication because they help financial institutions better understand borrower’s emotions and state of mind. Speech recognition, sentiment analysis and intelligent rules engine can be used to build psychological profiles, which reveal their state of mind and emotions. Call operators can use this information to keep borrowers calm and grounded. Furthermore, when recorded with an intelligence machine, conversations are recorded for future complaints and dispute resolution.

However, there are also privacy concerns to consider, so financial institutions should invest in a solid data management plan to ensure that all data is kept secure, and data strategies are implemented across the board. While these changes will improve earnings and customer appreciation, it will have a profound impact on both business and borrower, so it will take time to adjust to new operations.

The future of collections technology in the credit market

Technology is reshaping everything under the sun, collection is no different. AI is envisioned to play a huge role in the future of debt collection. Social distancing has already increased the industry’s dependence on digital technology, and this will not change in the future. We can also expect regulation to tighten, making collections even more challenging. Furthermore, the next generation of collection systems will utilise AI and analytics.

Given future trends and challenges, lenders need a strategy to improve collections while adopting a customer-centric focus. Using AI technology to assist customers will be more effective and ethical than pressuring them into paying.

Hurdles for financial institutions to consider

A sophisticated data infrastructure is important for debt collection, but there are several obstacles preventing financial institutions from investing in one. Skill gaps and cleaning data are just some of the challenges obstructing them. Furthermore, institutions need to set a data strategy and implement the right models, which is time-consuming, and institutions must be cautious about allocating resources for long-term projects.

Lenders understand the importance of utilising analytics and technology into the collection process. They know that by providing borrowers with a more tailored experience, this may produce better recovery. Institutions that are beginning to implement this more customer-centric approach will be ready to reap the benefits of a continued customer relationship and more effective collections.

International (EN)

International (EN) Indonesia (ID)

Indonesia (ID) Tieng Viet (VN)

Tieng Viet (VN) India (EN)

India (EN)