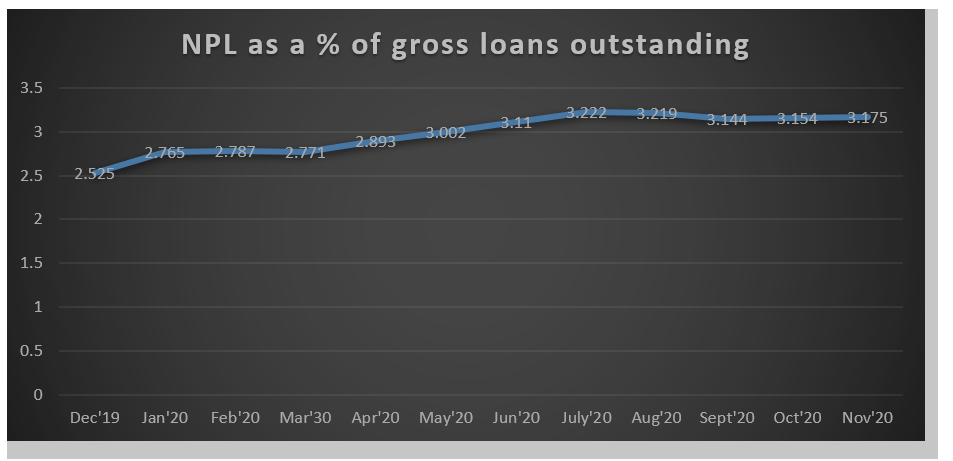

The continuing global recovery at the back of ongoing vaccination drive, fiscal and monetary stimuli is likely to continue through the full year in 2021. This augurs well for Indonesia as the financial market uncertainty will decline and economic growth will gain momentum. Indonesian banks had been battling a fierce battle throughout 2020 amidst the challenges posed by Covid-19. Though, the bank’s Non-performing loans (NPLs) were controlled due to the relief measures provided by the Central Bank yet it’s NPL figures still stand high at 3.175% as on Nov’20.

In total, a sizable 18% of system-wide loans have been restructured due to COVID-19, reports S&P. These restructured loans can be classified as performing until March 2022. Further, banks had low credit growth in 2020 at the back of pandemic impacting their overall profitability.

Promoting Digital Banking transformation

Given the low banking penetration in Indonesia, the Central Bank is trying to promote digital banking. Bank Indonesia is accelerating the digitalization of the payment system under the 2025 Indonesian Payment System Blueprint (BSPI 2025) to encourage the digital economy and finance as sources of economic growth. This accelerated digital payment transformation is focused towards integration of the national digital financial economy, particularly the retail and the micro, small and medium enterprise (MSME) sectors, banking digitization (open banking), interlinking digital banking with fintech etc. Digital transformation aims to provide data-based high analytical capabilities, digital business processes and international-standard information system services which will promote financial inclusion within the country.

In Dec 2020, the Asian Development Bank (ADB) also approved a $500 million policy-based loan to support the Government of Indonesia’s efforts to expand financial access among micro, small, and medium-sized enterprises and marginalized groups such as women and youth. This Financial Inclusion Program is aimed at helping the government to better target and track financial inclusion, improve the payments infrastructure, and strengthen the regulatory framework for digital financial services, data privacy, consumer protection, and financial literacy. The reforms will help in providing access to formal financial products and services, improving their quality, and increasing their use by financially underserved populations by supporting the policy and acting as technology enablers to foster innovations. Financial inclusion will also play an important role in Indonesia’s recovery from the coronavirus disease (COVID-19) pandemic. More equitable, efficient access to financial products and services will support government measures to mitigate the pandemic’s economic and social impacts, rebuild livelihoods, and prepare for future economic shocks.

While the government is trying to increase lending and bring maximum population under digital banking, it is also aiming at increasing financial literacy. It is trying to promote programs where borrowers are made aware of the importance of timely debt servicing, better financial management and savings prudence. Programs on cyber frauds, system security, over leverage, protection from unauthorised debt agents are regularly being conducted by financial institutions on demand of the central bank to avoid any misdeeds.

Banks and many financial institutions are maintaining interaction with customers in the midst of a pandemic to provide relevant insights, data and debt management techniques. This is mainly organised to literate and engage with the borrowers on the various options available to maintain healthy practices. While most of the banks within Indonesia have already moved towards digital platforms for payments and collections. There has also been an upsurge in peer to peer lending platform and Fintech firms which are using mobile devices for short term low ticket size consumer lending products. This has supported the borrowers which faced short-term liquidity stress due to the pandemic. However, some activists and economists have also warned of such credit surge mainly due to the vulnerability associated with this cash mismatch lending.

Expectations from 2021

Indonesia has shown some signs of economic recovery since it is mainly a domestically led consumption economy. Even exports have increased to some extent which is a positive sign for banks in 2021. While loan growth had been slow in 2020, however, as per the banking survey conducted by Bank Indonesia, a strong credit growth of 7.3% Y-O-Y is expected in 2021 as compared to 1.4% realised from Nov’20. This optimistic sentiment is a result of expected accommodative monetary and economic conditions, stronger positive economic growth, manageable credit risks and a positive result from the ongoing vaccination drive. Further the emphasis of the central bank on promoting digital literacy and financial inclusion is adding as a thrust to its credit growth. The main loan growth drivers for 2021 are expected to be working capital loans, consumer and investment loans.

In terms of NPL, it is likely to remain range bound given that the banks have already made heavy provisions of 2.5-3% of total loans for the spike in losses expected once the relief measures are withdrawn by the central bank. Indonesian banks’ capitalization is expected to stay strong. The Government emphasis and impetus towards digital literacy and financial inclusion will help the economy in the long term and will benefit the financial institutions at large.

International (EN)

International (EN) Indonesia (ID)

Indonesia (ID)