For the last two decades, the Indian economy had been one of the faster growing economies of the world. Like most nations, in these recent months, it has been crumpled by the COVID-19 led economic downturn. With no cure and timelines in sight, the full impact of the destruction is difficult to be estimated. However, as per Crisil Research report, India is predicted to see a decline of approximately 4% in its Gross Domestic Product (GDP) in FY21. This fall will directly impact the Indian banks which were already under stress due to their large Non-Performing Assets (NPAs) on their corporate advance books as banks increased their retail loan portfolio aggressively in the last two years.

The current crisis which is negatively impacting both the consumers as well as businesses is likely to create bigger problems for the banks from all fronts. The Reserve bank of India (RBI) has tried to give some leeway to the banks by protecting them from declaring any loan defaults for a fixed period of time and even extending loan moratorium. However, this has only acted as a deferment to the problem at hand. Ultimately, banks have is to find a long-term strategy to improve its credit qualities and collection efficiencies.

The current state of retail loans in India’s banks

The total gross outstanding credit of Indian banks at the end of March’20 stood at INR 92,631 bn registering a growth of 6.8% as against 12.2% growth in March’19.

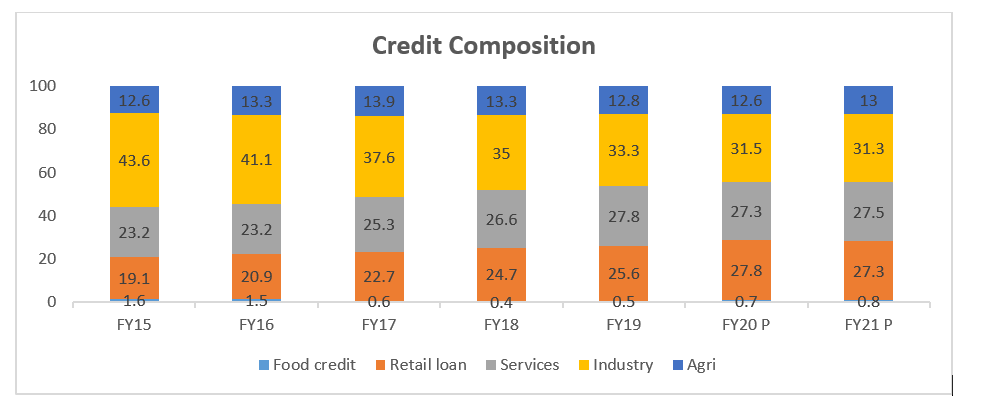

The banking credit composition has seen a dramatic shift from FY15 to FY20. While in FY15 industry (which mainly includes corporate advances) formed 43.6% of the total credit, the same declined to 31.5% of the total credit book. This reduction in advances was compensated by an increase in the retail and services sector loan portfolio which grew from 19% in FY15 to 28% in FY20 and 23% in FY15 to 27% in FY20 respectively.

The retail loan portfolio of banks comprise of housing, vehicles and other personal loans such as credit card, consumer durable loans, education, and unsecured loans. The retail portfolio has grown by 15% in March’20 over March’19 which represents almost two times the growth of overall banking credit (7% growth of banking credit in FY20 over FY19).

Housing loans forms the largest single segment of lending by banks at 14.4% of total bank credit outstanding. However, it may be noted that the growth in retail sector loans in FY20 had been mainly driven by consumer durable (47.9% growth in FY20), credit card outstanding (22.5% growth in FY20) and vehicle loans (9.6% growth). The demand drivers for retail loan growth has mainly been factors like strong demand, increasing consumption, improvement in demographic profiles, digitisation, easy availability of finances, competition, data security & privacy and declining cost of funds. Unfortunately, COVID-19 has ended this retail loan growth for India’s banks. Lenders may face their biggest recovery challenge in retail loans once loan moratorium has ended.

The road ahead for retail loans in India

In the last couple of years, the Indian Banking system had been earmarked with challenges- demand slowdown, poor capital expenditure, liquidity and capital constraints, bank mergers or takeovers, rating downgrades, and rising NPAs. In the midst of all these risks and falling banking credit, the COVID-19 pandemic has only come as a last straw on an already slowing economy.

As the Covid impact increased in India mainly from March 2020, the Indian economy was brought to a complete stall by government imposed lockdown with no movement of goods, services or persons. RBI also imposed restrictions on the banks towards interest and principle collection from its customers. Though the steps are getting relaxed over a period of time, but the effect of these measures is already seen in the form receding growth, job losses, worsening financial profiles of companies, and reduced cash flows. The overall outcome is expected to be negative in the end for the banking sector in general.

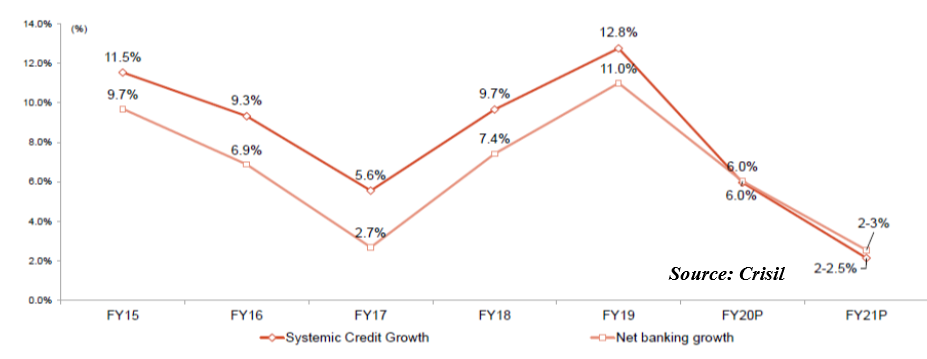

Bank credit growth is likely to slow down sharply to 2-3% for FY21. The incremental growth would also be led by Covid related loans, Government guaranteed loans and increase in working capital utilization levels on the back of elongated working capital cycle amid economic slowdown.

Systemic Credit includes Banking credit excluding that going to NBFCs, NBFC credit, and Corporate Bonds excl. those raised by Banks and NBFCs; P: Projected

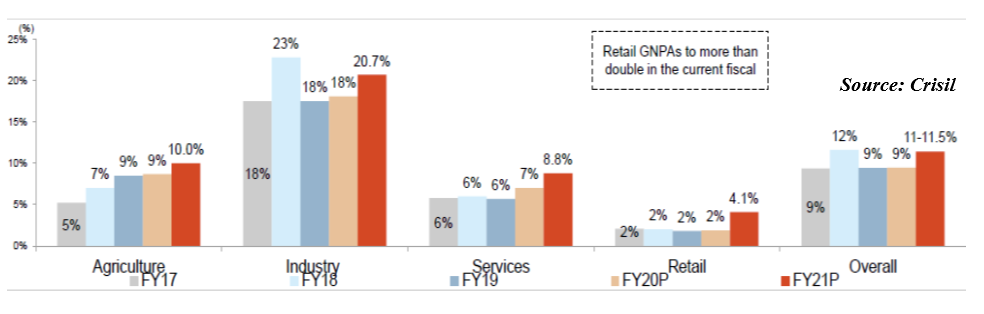

Along with a slowing credit growth, the banking system is likely to be impacted by a second blow which will be in the form of declining asset quality across all portfolio type including retail, services, and industrial. The retail segment which had been the main bread and butter of the banks books in the last 2 years is also likely to witness a significant deterioration in the asset quality especially in the unsecured loan segment (from 2% in FY20 to 4.1% in FY21). Given this dual hit, banking sector is projected to register negative profitability in FY21.

Moving forward

Given the strict regulations under which the banking segment operates, can something be done to improve the situation? To come out of the NPA surge, banks have two options. One is to continuously lend to increase the denominator of overall Assets under management. The banks can increase their portfolio by lending to various corporate, individuals, industries. However, given the already stressed conditions of the Indian corporate and lack of demand in the consumer credit market, these additional loans are likely to further deteriorate the asset quality.

Second option is to improve collection efficiency to decrease the numerator ie. reduce NPAs. Implement collection plans with increased vigor and efficiency by leveraging on advanced technology, analytics, third parties and shared services.

How can banks improve their collection efficiencies?

1. Strengthen in-house collection capacity:

Most of the banks already have an in-house collection infrastructure in place which has functions ranging from timely loan collections to building customer relationship, data analysis, and reducing NPAs. Additionally, each banks have product wise, well-defined delinquency buckets like DPD0, DPD1, DPD2, NPAs, and substandard assets to study and analyse its portfolio behavior. However, it may be noted an in-house team requires substantial infrastructure, capacities, and resources to operate. It also works on a fixed expense methodology where a sufficient amount of cost is utilised.

However, in most of the cases it is seen that the focus of the in-house collection team is inclined towards bigger and bulkier loans. Given the quantum of these loans, most of the energies are channel towards reducing NPAs of these corporate advances. Thus the consumer loan or retail loan book which comprise almost 40-60% of a bank’s total assets either gets completely missed out or stands ignored until the account becomes an NPA. Practically also, given the large volume, minuscule size, customer type and large geographical spread of these loans, it is challenging for banks to channelize their energies on such portfolio. Given the various limitations with this option, it is not a profitable and practical option for the banks to strengthen their internal collections teams. Banks which had not focused earlier to create in-house capacities may find it difficult to initiate it now for paucity of resources.

2. Debt Sale:

The second option available to the banks is to sell-off their portfolios to other banks, Non-banking financial companies (NBFCs) and Asset reconstruction Companies (ARCs) depending on the type, structure, classification and bucketing of the loan.

Selling of loan portfolios will allow lenders to focus on right portfolios according to their internal team capabilities & capacities and benefit by monetising on non-performing portfolios and realising time value of money.

3. Partner with an ethical credit management service provider:

The other way to improve collection efficiency is by hiring and outsourcing the complete or a part of collection process to external agencies. These agencies are managed by subject experts who partner with banks and clients and work on their behalf. This option doesn’t require banks to build a cost heavy internal infrastructure thus helping in reduction of fixed expenses.

Since these agencies offer Success Based Pricing meaning payout as a function of collections, the option gets profitably viable for the banks. These agencies use innovative technologies to send continuous reminders through omni-channel communications to the borrowers for repayments thus helping in reducing banking delinquencies.

However, it may be noted that using the services of a third party agency can also be dangerous because of various reasons. Firstly, misuse of data can hamper customers security and banks can be imposed to regulatory actions. At times, it is also seen that some of these agencies pester customers by using unethical means of collections. Hence, banks need to be extra vigilant and cautious in hiring only those partners which are trust-worthy, have substantial hand-on experience and vintage in this domain.

Conclusion

Given the recent tough times created by the spread of this world-wide pandemic, banks are likely to face dual blow in terms of reduction in asset book and deterioration in asset quality across portfolios. Thus their success in debt recovery will largely depend on the use of correct strategies concentrated towards delinquency reduction and portfolio protection. This can only be achieved if banks protect their losses by improving their collection efficiencies.

- FY: Fiscal Year 1st April-31st March

- NPA: Non-Performing Assets refer to assets which have not paid for 90 or more days. It is calculated as total gross NPA / to total advances (loans)

- DPD: Days Past Due or number of days the loan interest or principle has not been serviced.

International (EN)

International (EN) India (EN)

India (EN)