Vietnam economy pre- and post-COVID-19

Vietnam’s story of a country that rose from poverty to middle-income level status in 30 years embodies the narrative of Asian tigers. In the period between 2002 and 2019, World Bank figures show that Vietnam raised over 45 million people out of poverty. In the same period, the GDP per capita grew by 2.7 times. Specifically, Vietnam’s GDP growth rate in 2018 and 2019 was among the world’s fastest, at around 7%.

Many of these figures have changed since the onset of the COVID-19 pandemic. In terms of public health management, Vietnam is able to stay ahead of the effects of the disease. As of June 10, Vietnam had recorded 332 coronavirus infections, 330 recoveries, and zero deaths. It is a rosy picture viewed from the world’s perspective. Globally, there are close to 10 million infections, while fatalities are marching on to half a million points.

However, the ongoing crisis is affecting Vietnam in terms of diminished domestic demand and a disrupted export market. In fact, Vietnam recorded a decade-low GDP growth of 3.8% in Q1 2020 as the country fought the COVID-19 pandemic, banning flights, closing non-essential businesses and tourist hot spots. According to the World Bank, robust domestic demand and a vibrant export-focused manufacturing sector have been the strength behind Vietnam’s recent expansion. Considering that most of its neighbors, who are also the market for the country’s exports, have been hard hit, Vietnam’s GDP is set to decline in 2020.

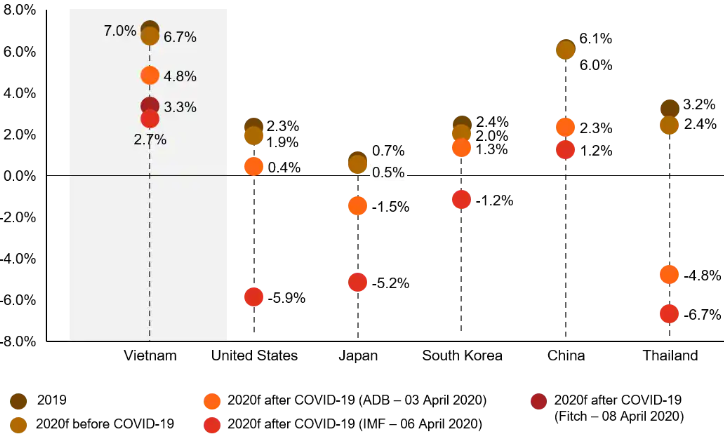

Despite the grim outlook for Vietnam and, indeed, the world’s economy, the country seems likely to escape without negative growth rates. Indeed, Vietnam and China are the only countries whose economies might not shrink in 2020, according to an analysis by PricewaterhouseCoopers (PwC). Vietnam’s economy is expected to grow by between 2.7% and 3.3% in 2020 after COVID-19.

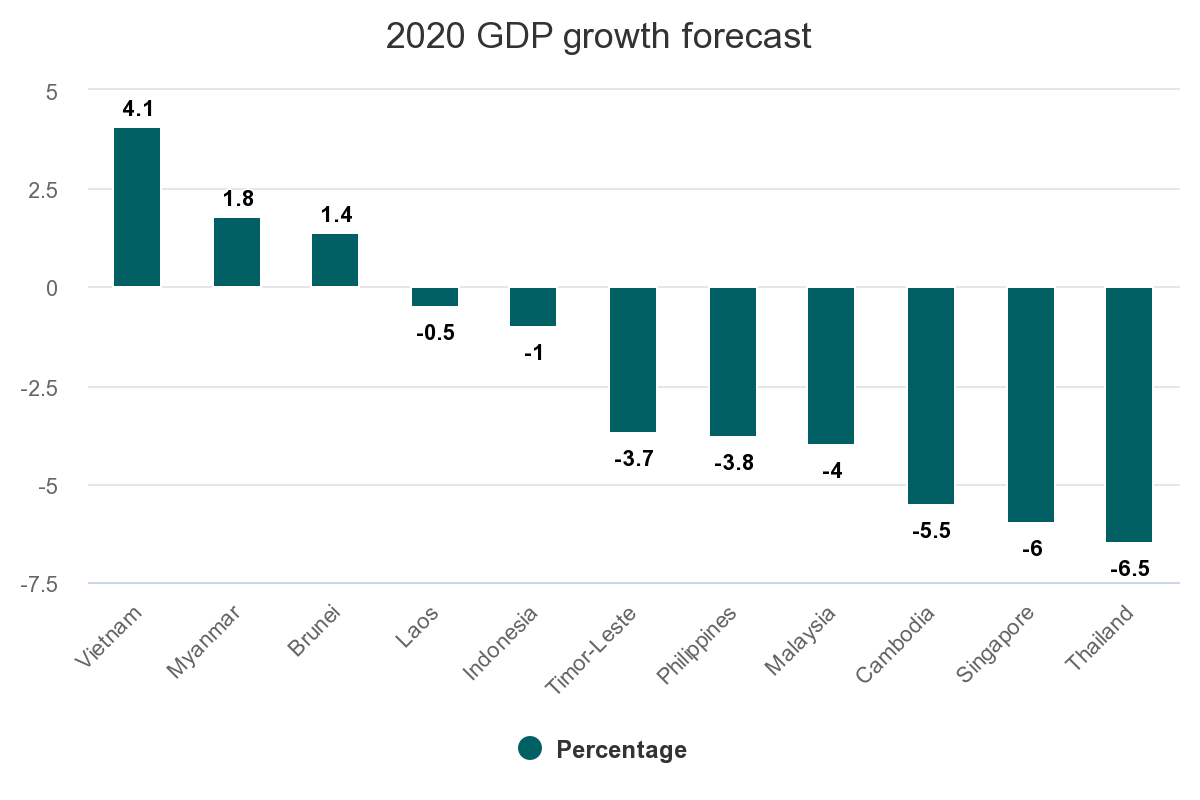

In fact, the Asian Development Bank (ADB) has forecast the highest 2020 GDP growth rate in Southeast Asia to be Vietnam at 4.1% despite the slowdown of Southeast Asia’s average GDP growth, estimated to contract by -2.7% this year and expected to rebound to 5.2% in 2021.

Figure 2 GDP growth rate forecast in Southeast Asia. Source: Asian Development Bank.

As of now, the decline in the GDP growth rate is straining financial institutions in terms of non-performing assets. Unique about this crisis is that both the supply side and the demand side of the economy are under recessionary pressures. In response, the State Bank of Vietnam (SBV) has taken mediator steps, including reducing policy rates (twice in less than two months). Additionally, the Ministry of Finance extended relief to various industries in terms of reducing administration and license fees. The sectors include water resources, financial services, banks, travel, and construction.

Also, according to State Bank of Vietnam (SBV), as of June 16, the credit growth of the banking industry is no more than 2.13%, the lowest level in the past several years, compared to the beginning of this year. Thus, in the first nearly six months of this year, credit growth was only half of that in the same period last year due to the serious impacts of the COVID-19 pandemic.

Therefore, credit growth in the first months of the year mainly depended on large commercial banks, but now lending is generally difficult to grow. The slow growth of credit activity reflects the market trend, economic activities, the situation of enterprises and socio-economic growth in the context of COVID-19 outbreaks.

Nevertheless, these actions do not solve the problem of non-performing assets for banks and other financial institutions. These institutions must develop strategies to address the efficiency of credit collection because of the unfolding COVID-19 pandemic.

The current state of Vietnam’s retail loan market

Banks are the most prominent players in Vietnam’s retail loan market, but that is not to wish away the increasing visibility of non-bank players. In the last year, the retail loan market has recorded a marked increase because of a vibrant digital banking ecosystem. Besides, P2P and alternative lending players have added to this growth by growing the size of consumer loans by between 7% and 8% by 2020, according to research data by The Asian Banker.

Overall, The Asian Banker believes that the entire retail loan market will grow by at least 18% in 2020. However, this might change depending on the behavior of the COVID-19 pandemic in the country and globally.

Retail loans in Vietnam are growing, especially after the advent of FinTech companies that provide P2P lending services. The most significant share of the retail loans, however, is offered by commercial banks. According to a Fitch Ratings report, by 2014, retail loans made up just 23% of Vietnamese banks’ loan portfolios. The report further noted that commercial banks are giving out more retail loans. Indeed, retail loans made up 40% of the loan portfolio of Vietnamese commercial banks, as said Fitch at the end of 2019.

The retail loans market comprises two major categories, which are mortgage loans and personal business loans. Since the onset of the COVID-19 pandemic, more than 10% (about 5 million people) of workers in Vietnam have lost their jobs. Although the State Bank of Vietnam (SBV) and the Ministry of Finance have combined efforts to mitigate the pangs of the crisis, its adverse effects are showing.

In the Fitch report, banks are facing a surging number of bad loans. The first quarter of 2020 saw Fitch-rated Vietnamese banks report bad loans as having jumped by 45% compared to Q1 2019. Vietnam might have kept COVID-19 under control, but the export market is still in crisis mode. As such, the possibility of economic uncertainties waning in the near future is in doubt. It means loan delinquencies might continue to rise.

Looking ahead for Vietnam’s retail loan market and the overall credit market

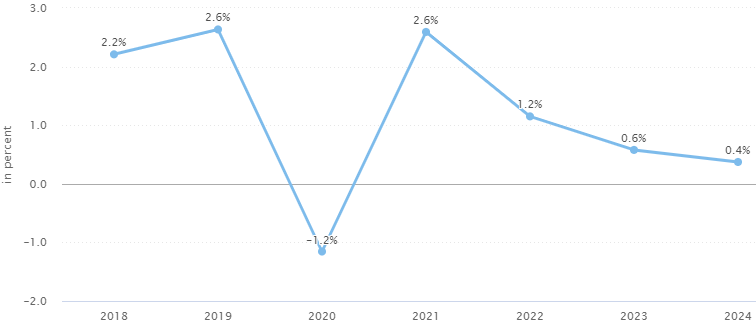

This year is about to witness the sharpest decline of the transaction value of retail loans in Vietnam when the impact of COVID-19 is taken into account. In 2019, the retail loans market reported a 2.6% growth in transaction value, but this is expected to drop to -1.2% by the end year 2020, which is about $0.09 million. To be sure, this analysis seems harsh, but, in actual sense, it is quite optimistic. It is because there are no definite timelines as far as the end of the COVID-19 pandemic is concerned.

Figure 3 Transaction Value Growth of Retail Loans in Vietnam. Source: Statista.

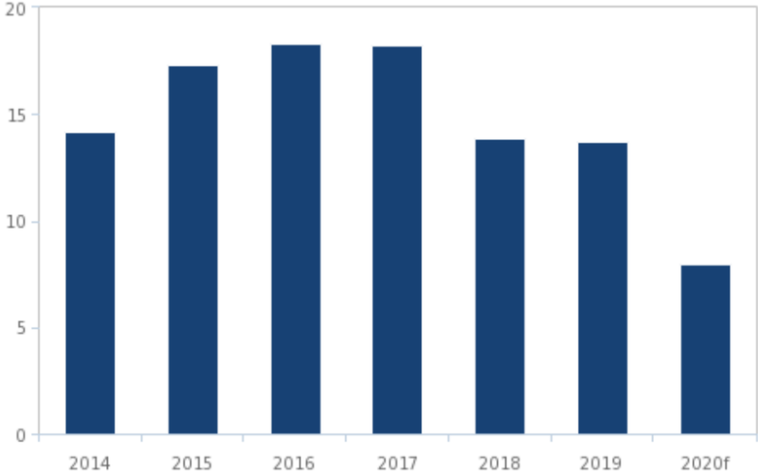

Nevertheless, the problem of declining growth is not for the retail loan market alone. Overall, Vietnam’s credit market is set to experience negative growth for 2020. Specifically, the surging rate of bad loans is likely to aggravate capital problems for commercial banks. Despite the SBV’s move to cut policy rates, the 5% refinance rate and the 3.5% discount rate seem insufficient to cushion the credit market from a sharp slowdown. Against this background, Fitch Solutions expects credit growth to slow down to 8% for 2020. Even this figure is on the requirement that the investment infrastructure of the country remains healthy.

Figure 4 Vietnam Credit Growth (%). Source: Fitch Solutions, as cited in Hanoi Times.

The way forward

The uniqueness of the current economic crisis in Vietnam implies that normal tactics cannot improve banks and other financial institutions. For instance, banks can resort to lending more to increase the share of performing assets. However, one is uncertain if such a move would do the banks any good. COVID-19 has adversely affected both the supply and the demand side of the economy. Therefore, even if consumers had money from loans to spend, it is unlikely that there would be sufficient supply to stimulate increased demand. What then is the way forward?

How can banks and other financial institutions improve the efficiency of their collection strategies?

1. Implement payment plans

These are uncertain times, and many borrowers might have been caught unawares. Having sent numerous payment reminders, one should accept that borrowers have cash flow problems if they fail to pay as agreed. Therefore, credit institutions might want to consider an extension to the payment time frame.

Payment plans are helpful not only to the borrower but also to the lender. On the one hand, they increase the chances of lenders redeeming bad assets. On the other hand, payment plans build loyalty among clients. Customers feel treasured when creditors seem to show an understanding of their dire situation.

2. Outsource collection to ethical third parties

Different third party collectors implement different collection strategies- some built on cutting-edge and current technologies. However, especially with the approval of the new Law on Investment 2020 by the Vietnamese National Assembly to eliminate unlawful debt collection related businesses, lenders need to exercise caution when partnering with these third party collections entities. They must ensure that the collectors are trustworthy, credible, and ethical.

Conclusion

Vietnam has done a great job in handling the COVID-19 pandemic, but the economy has not been spared from the global recession. The reason behind this is that Vietnam’s economy is deeply integrated into the global economy via reliance on exports. Consequently, loan delinquencies are surging, and the size of non-performing assets on lenders’ books is expanding. Hence, on top of the interventions by SBV and the Ministry of Finance, lenders need to restructure their credit strategies and keep them up aligned to the current issues in the country.

International (EN)

International (EN) Tieng Viet (VN)

Tieng Viet (VN) India (EN)

India (EN)